Final Risk Rating

This station will guide you through the application judgement on top of the mechanical risk signals.

The prudent application of judgement as a complement to model-based mechanical results, while avoiding excess discretion, is key for the final determination of the country’s risk rating.

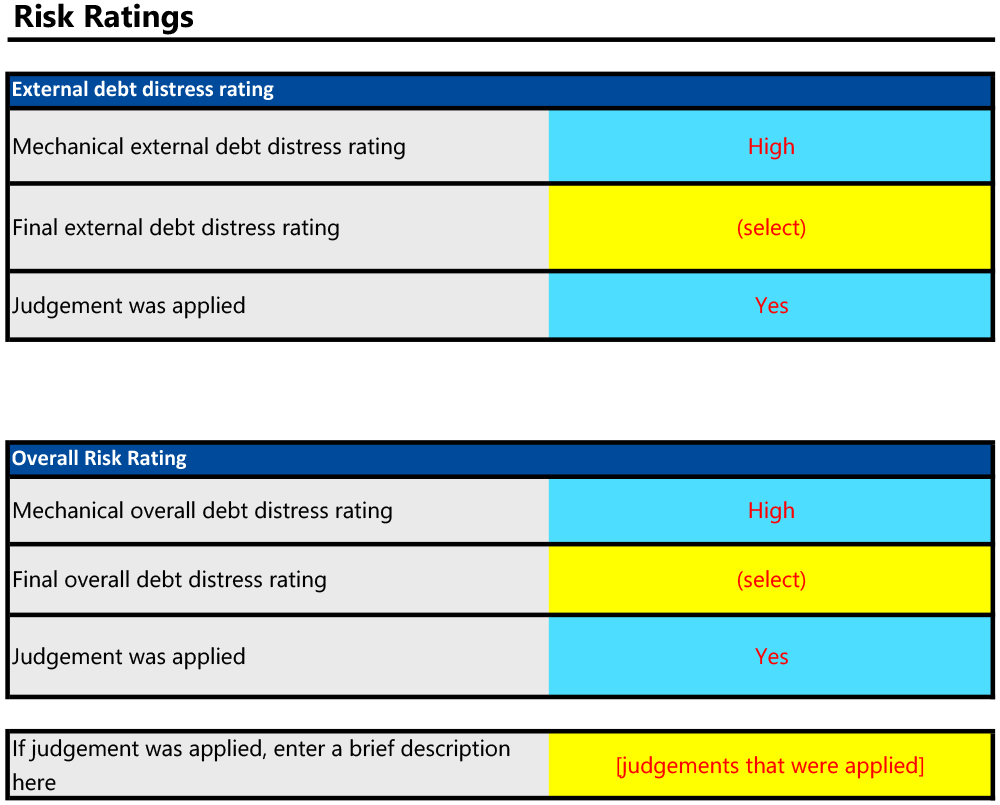

Risk Ratings

Low, Moderate, or High Rating

|

|

In Debt Distress RatingNotwithstanding a mechanical signal that accounts for other factors, a country should be rated as In Debt Distress (subject to a few qualifications noted below):

|

The following qualifications apply to debt restructuring and arrears:

-

Voluntary market-based debt re-profiling

- De minimis cases in which arrears are less than 1 percent of GDP

- Cases in which arrears arise due to technical problems, disputed claims, diplomatic disagreements, difficulties in establishing the appropriate counterparts for payment, or weak debt management

- Cases in which arrears to official bilateral creditors have been deemed away due to the existence of a debt relief agreement

- Cases in which arrears were granted to private creditors when debt restructuring with the majority of creditors had been completed, and where the government is judged to be engaging in “good faith” negotiations with the remaining holdouts.

In the template, this table is in the “Output 7” sheet.

| Country X Joint Bank-Fund Debt Sustainability Analysis |

|

|---|---|

| Risk of external debt distress | Please select the final external rating |

| Overall risk of debt distress | Please select the final overall rating |

| Granularity in the risk rating | Enter applicable granularity in the risk rating: sustainability/moderate risk tool/tool not applicable |

| Application of judgement | Yes: judgements that were applied |

In the "Output 7" sheet, you need to select the final external and overall risk of debt distress ratings in the yellow-highlighted cells.

If any judgement was applied, a brief explanation of the applied judgement should also be entered.

Takeaways for Station 9

Takeaways for Station 9

- The final risk rating is the product of the mechanical risk signal and careful application of judgement.