Debt-Carrying Capacity

Station 4 demonstrates how to determine each country’s debt-carrying capacity and derives the respective thresholds for debt indicators.

|

|

Substation 4.1 - CI Inputs Substation 4.2 - Thresholds and Benchmarks |

|

Countries with different policy and institutional strengths, macroeconomic performance, and buffers to absorb shocks, have different abilities to handle debt. Such abilities are also influenced by the global environment through demand for LICs’ exports and remittance inflows into LICs.

A country’s debt-carrying capacity is established to determine the debt and debt service thresholds that will apply when assessing the extent of risks. Countries are classified based on a composite indicator using country-specific information.

The weak, medium, and strong debt-carrying capacity categories determine the country’s thresholds for the external DSA and the benchmark for the public DSA.

Composite Indicator (CI) for Classifying Countries

The previously used LIC DSF World Bank Country Policy Institutional Assessment (CPIA) has been replaced by the Composite Indicator (CI), which includes CPIA plus other macroeconomic variables.

CI Inputs

- The CI uses 10 years of data (5 years of history and 5 years of projections) to smooth out economic cycles and encourage forward-looking policy discussions.

- Mixing historical data and projections allows the framework to capture ongoing changes in the outlook for each country’s fundamentals.

- CI classification of any given LIC is weak, medium, or strong.

Composite Indicator

The algorithm for deriving debt thresholds uses an aggregation rule to combine information from the probit regressions, and selects the debt thresholds to minimize a prediction loss function that penalizes Type I and Type II errors. The process can be broken down into the following five steps:

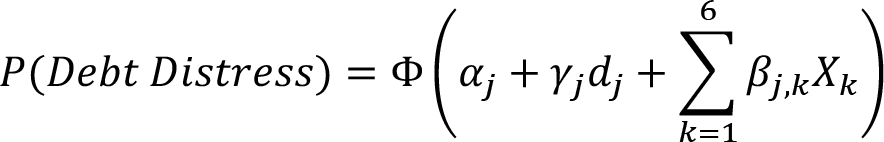

Step 1: Estimate a probit model for each debt burden indicator

where 𝑑𝑗 represents the four different debt burden indicators (PV of debt to GDP, PV of debt to exports, debt service to revenues, and debt service to exports) and 𝑋𝑘 represents the non-debt explanatory variables included in the probit regressions (CPIA, country growth, reserves, squared reserves, remittances, and world growth).

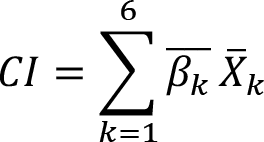

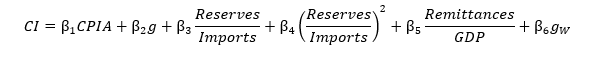

Step 2: Construct a composite indicator (CI) reflecting the contributions of all the non-debt explanatory variables to the risk of debt distress. The CI is defined as:

where 𝛽𝑘 is the average slope coefficient across the four probit regressions for each explanatory variable and 𝑋̅𝑘 is a 10-year average of each of the explanatory variables prior to the episode. Benchmark values for the strong (medium) (weak) categories are set at the 75th (50th) (25th) percentiles of the distribution of the CI over the most recent 2005-14 period.

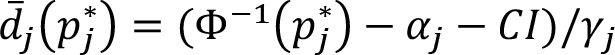

Step 3: Given a cutoff probability for each debt burden indicator, 𝑝𝑗, “invert” each of the estimated probit regressions to obtain debt thresholds 𝑑̅𝑗(𝑝𝑗) as a function of the CI:

Evaluating these thresholds at the 75th (50th) (25th) percentiles of the distribution of the CI over the 2005–14 period results in debt thresholds for the strong/medium/weak categories for each of the debt burden indicators.

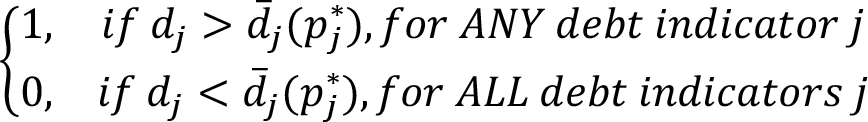

Step 4: Define a prediction rule for predicting debt distress that is consistent with the practice of the DSF. Specifically, the DSF signals a high risk of debt distress (𝑦̂ = 1) if any of the thresholds is breached, i.e.,

In determining whether the threshold is breached for a particular episode, the observed debt level is compared with the debt thresholds for the strong/medium/weak categories, where the latter determination is based on comparing the country-specific CI with the benchmarks described in the previous step: a country is compared with the debt threshold for the weak category if its CI is below the 25th percentile of the 2005-14 average CI, with the threshold for the strong category if its CI is above the 75th percentile, and with the threshold for the medium category otherwise.

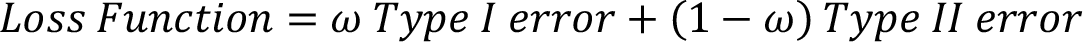

Step 5: Select the cutoff probabilities 𝑝𝑗 for the four debt burden indicators, and the corresponding predictions of debt distress, to minimize a prediction loss function that penalizes Type I error (“missed calls”) and Type II error (“false alarms”) with transparent weights:

The weight on Type I error is set at 𝜔 = 0.67.

Composite Indicator

The debt thresholds were derived based on the probit regressions underlying the LIC DSF.

The calculation of the latest and past CI scores are found in the “CI Summary” sheet of the latest published template.

CI is calculated as the weighted sum of the non-debt predictors of debt distress, where the weights are given by the average estimated coefficients across several statistical models.

Exercise: Input your 10 year average values in the table below. Click 'Enter' on your keyboard to see the result.

The CI is calculated as follows:

where g and gw are growth and world growth respectively, and where all variables are in percent, except the CPIA score.

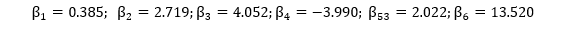

The coefficients are:

Reserves are measured in percent of imports.

The reserves2 term is calculated as follows: (the ratio of reserves scaled by imports)2 *100. For example, if reserves are 26.244%, reserves2 is calculated as (26.244/100)2*100

Reserves are measured in GDP.

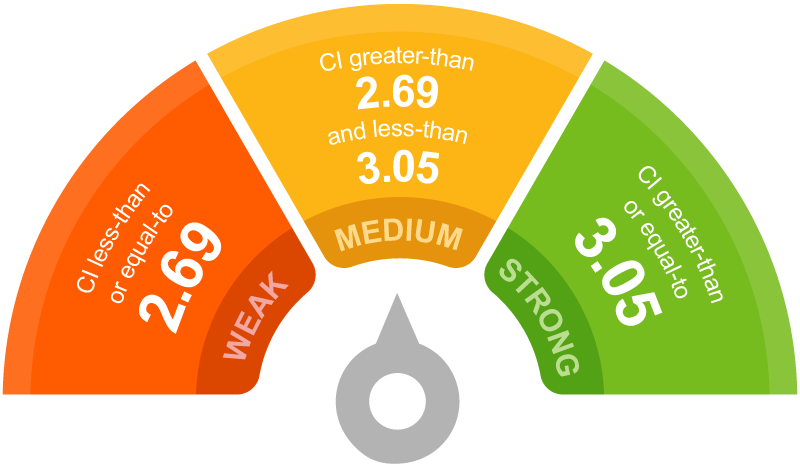

CI Debt-Carrying Capacity

Assessing a Country’s Debt-Carrying Capacity

The composite indicator falls below the 25th percentile of this distribution

The composite indicator falls at or between the 25th and 75th percentiles

The composite indicator falls beyond the 75th percentile (see illustrative cut-off values)

CI Updates and Sources

Frequency: The CI is calculated twice a year based on the April and October World Economic Outlook Reports (WEOs), and the CPIA released by the World Bank in July, then predetermined/frozen between these two points.

CI Updates and Sources

The CI and the underlying data is published on the IMF and World Bank websites, IMF and World Bank.

Potential changes to a country’s CI classification:

Changing the current CI classification requires two consecutive signals to avoid volatility in classification while recognizing ongoing policy changes.

THRESHOLDS AND BENCHMARKS

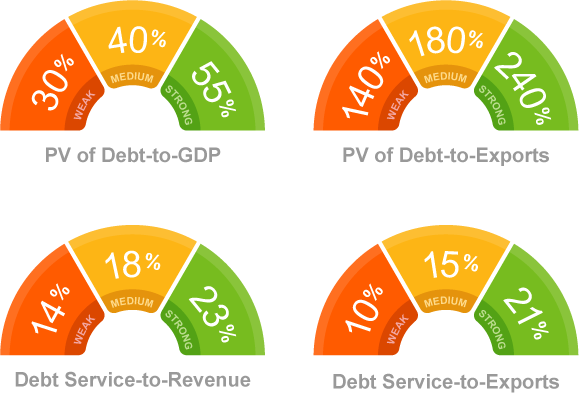

Thresholds for PPG External Debt

- Countries that remain at weak or medium capacity should pay special attention to the debt service threshold and minimize liquidity risks from their future debt service.

Benchmark for Total Public Debt

Takeaways for Station 4

Takeaways for Station 4

- A country’s debt-carrying capacity is determined by 5 years of historical data and 5 years of country-specific and global projections.

- The Composite Indicator (CI) is a weighted average of the country’s CPIA score computed by the World Bank, the country’s growth, reserves, remittances, and world growth.

- The weights are based on the statistically estimated coefficients for each variable; are the same for every LIC; and will remain unchanged until the next LIC DSF comprehensive review.

- Based on the country’s debt carrying capacity (weak, medium, or strong), the LIC DSF has four thresholds for the PPG external debt and one benchmark for the total public debt.

- These thresholds apply to the ratios of stocks, such as external PPG debt-to-GDP and external PPG debt-to-exports, which are depicted in present value terms to reflect a very long projection horizon of 20 years. They also apply to ratios of flows, such as external PPG debt service-to-revenue and external PPG debt service-to-exports.

- The benchmark refers to the present value of the total public debt-to-GDP, which includes PPG external as well as public domestic debt.