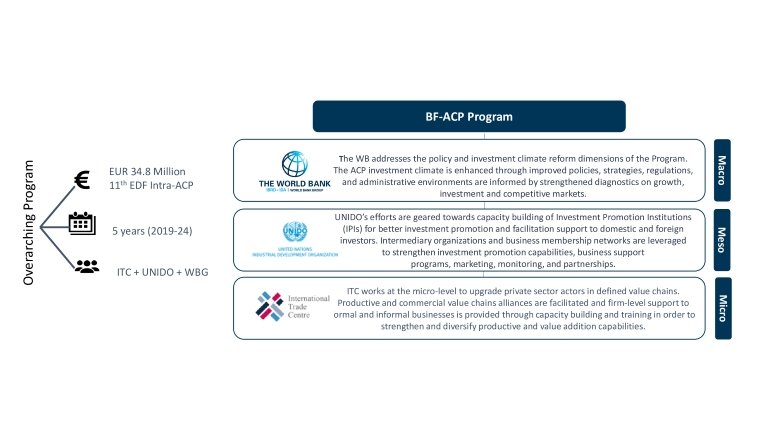

“ACP Business-Friendly: Supporting value chains through inclusive policies, investment promotion and alliances” (ACP BF) is an Intra-ACP action funded by the European Union (EU) and the Organization of African, Caribbean and Pacific States (OACPS).

ACP BF is scheduled to run from 2019 to 2024 and supports ACP countries, ACP regional economic communities (RECs), national investment promotion agencies (IPAs) and institutions (IPIs), ACP national investment climate reform bodies, regional private sector development organizations and associations, and ACP agriculture value chain actors alongside SMEs.

The Program follows a tiered approach with engagements focusing on macro-, meso- and micro-level interventions implemented by the World Bank (WB), the United Nations Industrial Development Organization (UNIDO), and the International Trade Centre (ITC), respectively.

Development Objective

The specific objective of the Program is to support business-friendly and inclusive national and regional policies as well as to strengthen productive capacities and inclusion into global value chains (GVCs). The action is thus designed to achieve two key outcomes of:

- Adopting and implementing business-friendly, inclusive, and responsible national policies and legal frameworks.

Strengthening productive, processing, promoting, and marketing capabilities and value chains.

The WB is implementing the macro-level component of the Program, with interventions to support increased investment in support of the creation of jobs and economic transformation. Expected results include greater regional/intra ACP and global investments and improved firm-level outcomes that will enhance countries’ competitiveness and access to value chains.

Program Description

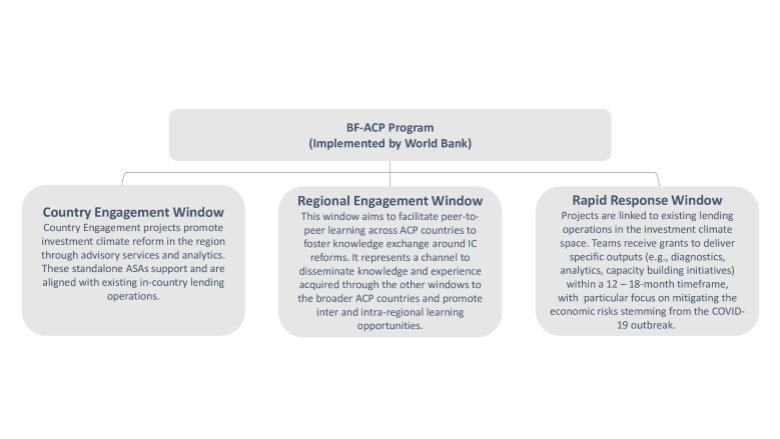

The WB’s macro-level assistance is provided through three project delivery windows: the country engagement window (CEW), which provides for deep technical support on the Program’s themes for governments; the rapid response window (RRW), which provides expedited support to client countries in addition to the main program themes, largely focused on mitigating the economic risks stemming from COVID-19; and the regional engagement window (REW), which facilitates peer-to-peer learning and provides a channel for knowledge dissemination as well as inter- and intra-regional learning opportunities. Each window seeks to build on existing WB operations and leverage the substantial WB development footprint in the OACPS member states.

Consequently, the WB’s support focuses on two complementary themes, namely:

- Improving policy, regulatory, and administrative environments informed by strengthened diagnostics on growth, investments, and markets. This assistance concentrates on improving conditions required for the growth of private investment in ACP countries. It addresses barriers to businesses’ ability to enter, establish, grow, and compete in ACP economies and regions. The action also addresses gaps in countries’ investment attraction and retention strategies, which should align with agreed national policy approaches, by working with national institutions, including investment promotion agencies and Ministries of Commerce, Investment, Industry, or similar. It aims to enhance overall regulatory transparency, effectiveness, and predictability for local and cross border businesses and investors, while reducing compliance costs and regulatory room for excessive discretion.

- Improving the FDI policy environment and developing or enhancing strategies for linking foreign investors with domestic firms. This support centers on enabling key drivers required for companies to compete regionally and internationally, addressing gaps in the design and effectiveness of investment incentives and supplier programs, and boosting quality infrastructure standards together with facilities to support adherence by the private sector.

Through these initiatives, the WB aims to secure more and better jobs through (a) an enhanced investment climate, supported by investment diversification to non-resource-based sectors; (b) a conducive policy and regulatory environment that promotes new entrants, and instils confidence for investors to stay and expand; and (c) quality infrastructure to help domestic firms upgrade their competitiveness and facilitate integration into GVCs.