Strategy

The World Bank Group is supporting our clients to achieve their smart development goals, which include meeting their own Nationally Determined Contributions (NDCs). This includes projects that are building resilience, or that are managing emissions responsibly.

Last year, 48% of WBG financing qualified as having climate co-benefits under the shared MDB methodology—exceeding our own expectations. This includes projects that are building resilience, or that are managing emissions. Building resilience means we build roads that can withstand a flood, and schools with insulation and reflective roofs, so outside temperatures don’t impact learning inside. We help farmers source drought-resistant seeds, so a dry season doesn’t wipe out the harvest or income. Mitigation means smart development that manages emissions responsibly.

We are guided by our Climate Change Action Plan 2020-2026, which outlines our support to countries to accelerate their development ambitions in line with their own nationally determined contributions and long-term strategies.

Activities

The World Bank Group delivered $50.8 billion in development finance with climate co-benefits in fiscal year 2025—which covers July 1, 2024 to June 30, 2025. Within that, resilience made up 43% of the public sector portfolio—up from one-third just two years ago.

We have supported 81 countries to identify how to accelerate their development ambitions in line with their own nationally determined contributions and long-term strategies through Country Climate and Development Reports.

These CCDRs help countries identify how to accelerate their development ambitions in line with their own nationally determined contributions and long-term strategies. Countries are tapping into our development knowledge to gain expertise, especially in strengthening the enabling environment for private sector investment and supporting smart development in their local communities and local businesses.

In 2024, we partnered with other Multilateral Development Banks (MDBs) to launch a common approach for measuring resilience outcomes in a more systematic way. This approach pivots from mostly measuring the volume of our finance with climate co-benefits, to also measuring results. In addition to disclosing climate co-benefits (mitigation and adaptation) data for each project, the World Bank started disclosing sub-project level climate finance data, from April 1, 2025 and climate finance at the close of each project from July 1, 2025.

Since 2008, we have issued approximately $19 billion equivalent through over 220 labeled (green, blue) bonds in 28 currencies. We have also engineered new instruments, whether issuing the Bank’s first sustainability linked loan to Uruguay to improve livestock productivity and decrease their footprint, or developing new instruments including outcome-based bonds or guarantees that have supported carbon markets.

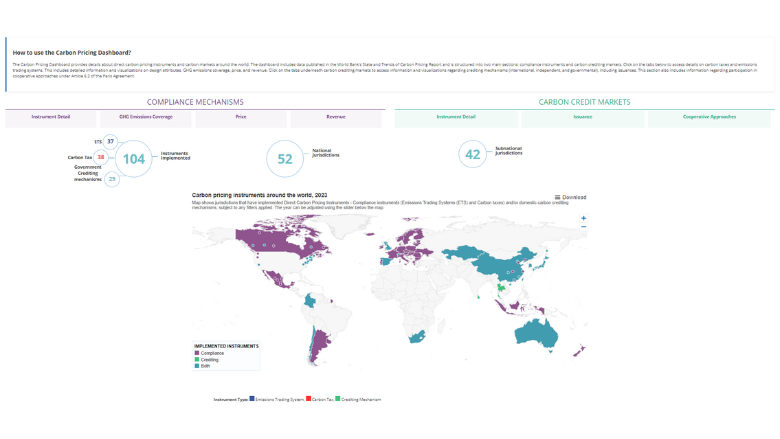

We are working with over 30 countries in establishing domestic carbon pricing mechanisms and preparing for the next generation of international carbon markets. We are also helping countries to design and implement large scale programs that generate high integrity carbon credits in the forests and other sectors.

And we are supporting nature-based solutions to development challenges such as using soil stabilization to reduce erosion, and mangrove restoration to improve fisheries and protect coastal infrastructure from wave inundation. The World Bank currently has around $13 billion active investments in environment, natural resources, and the ocean.

As part of a blueprint for methane reduction, through the Global Methane Reduction Platform For Development (CH4D) platform we are supporting 35 country-led programs to deliver better rice production, livestock operations and waste management systems with methane reduction, enhanced environmental resilience and improved livelihoods.

We have significantly expanded our crisis toolkit in several ways: broadening the scope of our Climate Resilient Debt Clauses to now cover disasters such as droughts, floods, and pandemics, offering vulnerable countries much-needed financial flexibility during crises.

Last Updated: Oct 09, 2025