RESULTS

Supporting Governments in Debt Management Strategies

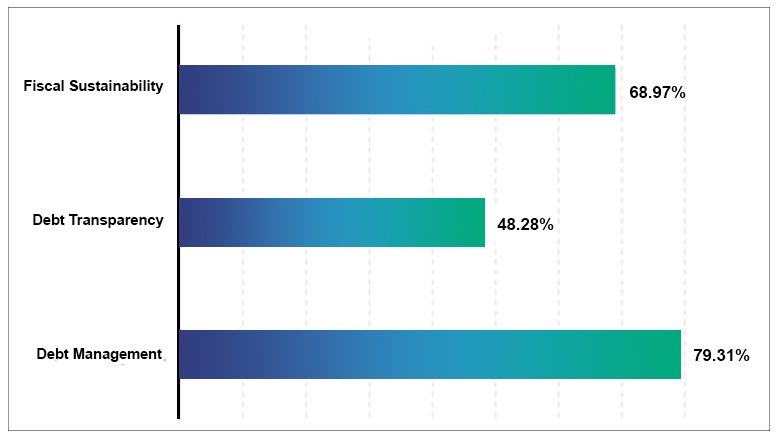

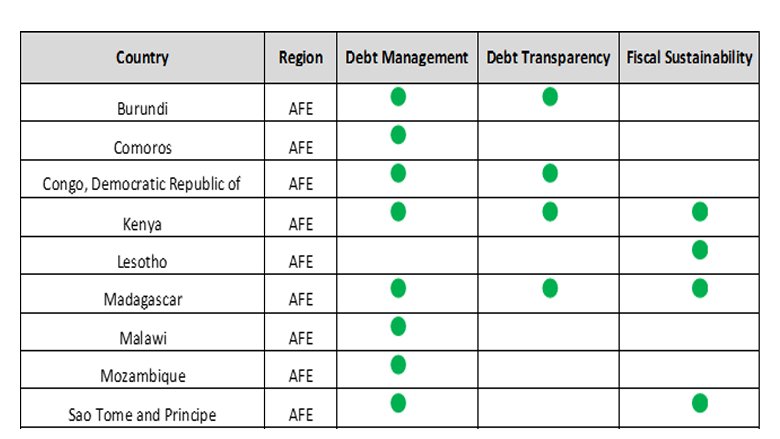

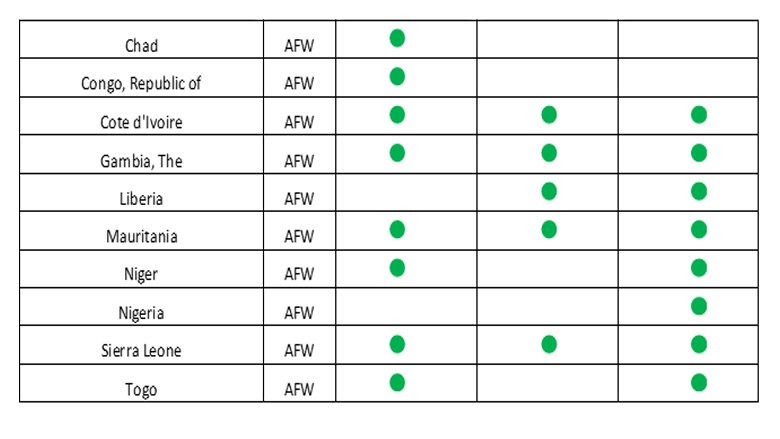

In FY23, 36 countries in Africa out of 63 IDA countries globally were required to prepare Performance and Policy Actions (PPA), under the SDFP. 29 countries, 14 in Eastern and Southern Africa and 15 in Western and Central Africa, had approved PPAs in this period, of which 48 percent addressed at least one PPA on debt transparency. Furthermore, 79 percent of countries in the region have at least one PPA that addresses debt management and 69 percent that address fiscal sustainability. In Kenya, the Bank has helped strengthen the Public Debt Management Office since 2019, supporting a decline in debt owed to commercial sources, from a peak share of 35.6 percent in 2019 to 28.8 percent in 2021. The second Inclusive Growth and Fiscal Management Development Policy Operation (DPO) in Kenya also supported the government’s transparency efforts in publishing tender documents through an online portal, as well as providing for penalties for collusive behavior. From a base of zero in 2017, the cumulative 2021 value of contracts published amounted to around $3.4 billion.

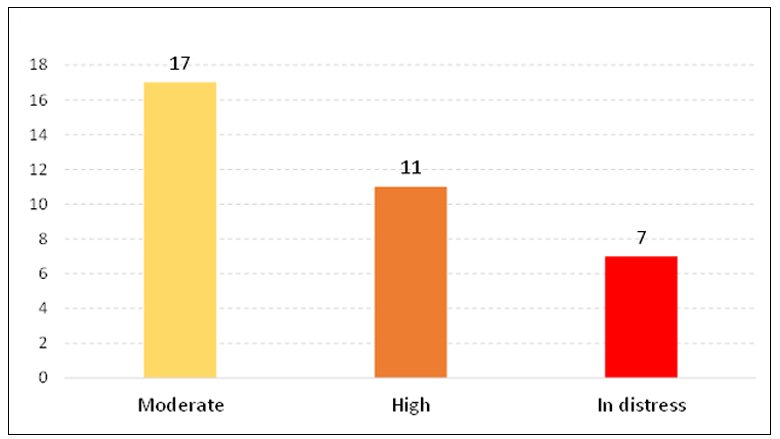

In 2021, after several years of decline in gross national income (GNI) per capita, exacerbated by the impact of the COVID-19 pandemic, Zambia was re-classified as low-income for the first time since 2011, with 60 percent of the population living on less than $1.90 a day. At the same time, the Zambian Government was facing the challenge of unsustainably high levels of sovereign debt; without a timely debt resolution, the development gains that Zambia had achieved in the past two decades would be wiped out. In February 2022, Zambia formally requested a treatment of its debt from the Paris Club in application of the Common Framework - a mechanism created by the Group of 20 major economies in late 2020 to help poor countries weather the fallout from the COVID-19 pandemic - for debt treatment beyond the Debt Service Suspension Initiative. The IMF Executive Board approved a $1.3 billion 38-month Extended Credit Facility (ECF) Arrangement in August of that year. Restoring macroeconomic and debt sustainability, strengthening governance, and promoting private-sector-led inclusive growth are critical areas of the World Bank’s work with the Zambian government. The Bank is working closely with the IMF, the G20, and the Creditor Committee to support the Common Framework process as a path to long-term debt sustainability.

In November 2022, the government of Chad reached an agreement with its creditors that paved the way for more funding from the International Monetary Fund under the Common Framework. The agreement allowed for a further disbursement from Chad’s $572 million, four-year Extended Credit Facility (ECF) program with the IMF. The ECF provides medium-term financial assistance to low-income countries with protracted balance of payments problems. The Liberia Inclusive Growth DPO Series helped increase the number of state-owned enterprises (SOEs) with debt published in the Public Debt Management reports from 0 in 2020 to 15 in 2022, and is helping reduce tax expenditures from 33 percent of revenues in 2018 to a target of 20 percent by 2023.

In 2022, Burundi’s nominal public debt stood at $1.9 billion, or 54.6 percent of GDP, with domestic debt representing 77 percent of the total. However, the government has made efforts to ensure that the debt risk rating does not deteriorate further, and has reached an agreement with IMF on economic policies and reforms to be supported by a new 40-month Extended Credit Facility. The reform program aims to support the economic recovery from shocks, restore external sustainability, and strengthen debt sustainability while creating fiscal space for accelerated and inclusive growth. As a result, Burundi is expected to have access to more external borrowing sources, using various borrowing instruments. The Ministry of Finance, Budget, and Economic Planning (MFBEP) requested the assistance of the World Bank to bring Burundi’s debt management framework and practice up to par with international standards and strengthen the country’s capacity in debt management; activities undertaken in response to this request are financed under the DMF.

Benin has been able to balance the needs of infrastructure investment, social programs, and fiscal discipline with the support of World Bank guarantees. Benin reached out to the World Bank in 2019 for support in poverty-reducing policy reforms, financing social investments, and refinancing short-term domestic debt – all of which it needed to achieve on a $60 million IDA allocation. IDA offered to support Benin with $180 million equivalent of policy-based guarantees (PBGs), which cover commercial lenders against the risk of debt service default by sovereign governments. MUFG Bank of Japan provided a loan of $278 million and Credit Suisse $136 million, bringing the total raised to $414million; this was the first time in World Bank history that PBGs were leveraged to support commercial loans to a sovereign in Africa. Benin used the first €260 million to replace their short-term domestic debt with external commercial financing at longer maturity (12 years) and a much lower interest rate, achieving a savings of around 0.5 percent of GDP in present value terms over the life of the loan. Since this was a policy-based guarantee, the government also carried out significant poverty-reducing reforms, for example by providing more equitable access to education and health services. This approach was made possible by the incentive that IDA provided. In 2019, only 25 percent of the amount of the guarantee would count towards the annual country allocation. Since then, the policy incentive has been removed, and the amount of a guarantee counts 100 percent towards the annual allocation.

Burkina Faso Achieves Full Disclosure Among the 74 IDA countries, only Burkina Faso has ever met the “full disclosure” rating for every single one of the nine categories on the World Bank’s Debt Transparency Heat Map – a remarkable achievement considering that the country has been classified as fragile and conflict-affected since late 2020 and has been fiscally squeezed by the COVID-19 crisis and has an internally displaced population of almost 2 million. Between 2015 and 2020, the government’s gross financing needs tripled, followed by an increase in borrowing from expensive domestic and regional capital markets to close the gap. Burkina Faso partnered with the DMF to improve debt transparency under a broader World Bank DPO. The partners designed a roadmap of reforms for 2021, with step-by-step instructions to publish Statistical Debt Bulletins in line with international sound practices. The country’s borrowing costs have since gradually decreased for all debt instruments, the maturity of bonds has been extended from five to ten years to mitigate liquidity risks, and the country produces high-quality debt bulletins on time. As of June 2022, Burkina Faso’s access to the regional capital markets remains strong, and its funding costs, particularly for shorter-term borrowing, are among the lowest in the region. A feature of the DPO was the close collaboration between the government and the DMF, which working largely remotely helped Burkina Faso build the debt management office's capacity for debt reporting. “The DMF experts virtually trained officers of the debt office, analyzed collegially with them data captured in the debt recording systems, and made recommendations for enhanced debt reporting,” says Daniel Pajank, Senior Economist for Burkina Faso at the World Bank. |

In Togo, in 2022, the World Bank carried out a Debt Management Performance Assessment (DeMPA) aimed at evaluating the debt management practices implemented by the government in the previous 12 years. As a result, the minimum requirements of 75 percent of indicators were met compared to those achieved at 30 percent in the 2010 DeMPA, an important improvement. Nonetheless, there are still some areas to be enhanced, including fiscal risk analysis and introduction of external audit of debt management operations.

In Angola, the World Bank supported the reduction of interest rate risks on 98 percent of their International Bank for Reconstruction and Development (IBRD) outstanding debt amount and helped create up to $270 million in potential savings on the estimated interest repayment. After receiving training from the World Bank on financial risk management and after analyzing market projections for inflation, the country requested interest rate conversions for most of its disbursed IBRD loans, benefitting from the embedded conversion option of the IBRD Flexible Loan (IFL).

Countries in unsustainable debt situations undergoing a comprehensive debt restructuring receive targeted assistance to quickly improve the quality and scope of their debt recording and reporting, with the support of the DMF and the Government Debt and Risk Management Program (GDRM). In January 2021, the World Bank, together with the IMF, supported Somalia in improving its legal framework for debt management operations, its debt recording practices, and its debt publication. As a result, Somalia resumed the publication of detailed quarterly debt bulletins that tracked the amount of debt relief that Somalia is receiving under the Heavily Indebted Poor Countries Initiative. Following its announcement to restructure its external debt under the G20’s Common Framework in December 2022, the government of Ghana, with the support of the GDRM, reviewed its debt reporting practices with the aim of improving the scope of external and domestic debt reporting.