BACKGROUND

For decades, these countries, as with the rest of the world, were accustomed to a linear way of producing, consuming and discarding plastic products. Now, they are taking regional leadership to move toward plastic circularity and combat the economic, environmental and social consequences of marine debris. This marine plastic study series addresses the critical need for country specific market assessments of plastics recycling in Thailand, Malaysia, and the Philippines. While reuse/refill and other business model aspects of plastic circularity are briefly evaluated, the studies focus on recycling as a scalable private sector solution for diverting plastic waste away from landfills and the open environment. The studies use a plastic value chain approach to engage key stakeholders, compile baseline data, develop material flow analyses, identify plastic recycling barriers and opportunities, and develop actionable recommendations.

METHODOLOGY

- Each study delineates the size and scale of the country’s plastics production and recycling industry, focusing on four key recyclable resins: Polyethylene Terephthalate (PET), Low Density Polyethylene (LDPE), High Density Polyethylene (HDPE) and Polypropylene (PP).

- The study team consulted with resin manufacturers, brand owners, converters, aggregators, and recyclers across the plastic value chain to compile and develop baseline data for each targeted resin.

- These on-the-ground activities were complemented with additional data from secondary desk research and government agencies to develop material flow and material value loss analyses to quantify the untapped market potential for each resin. The pressures that contribute to this material value loss were identified for each country.

- These findings were used to inform public and private sector interventions and near- and long-term actions to help each country address the unique plastic circularity policy and market barriers identified.

KEY FINDINGS

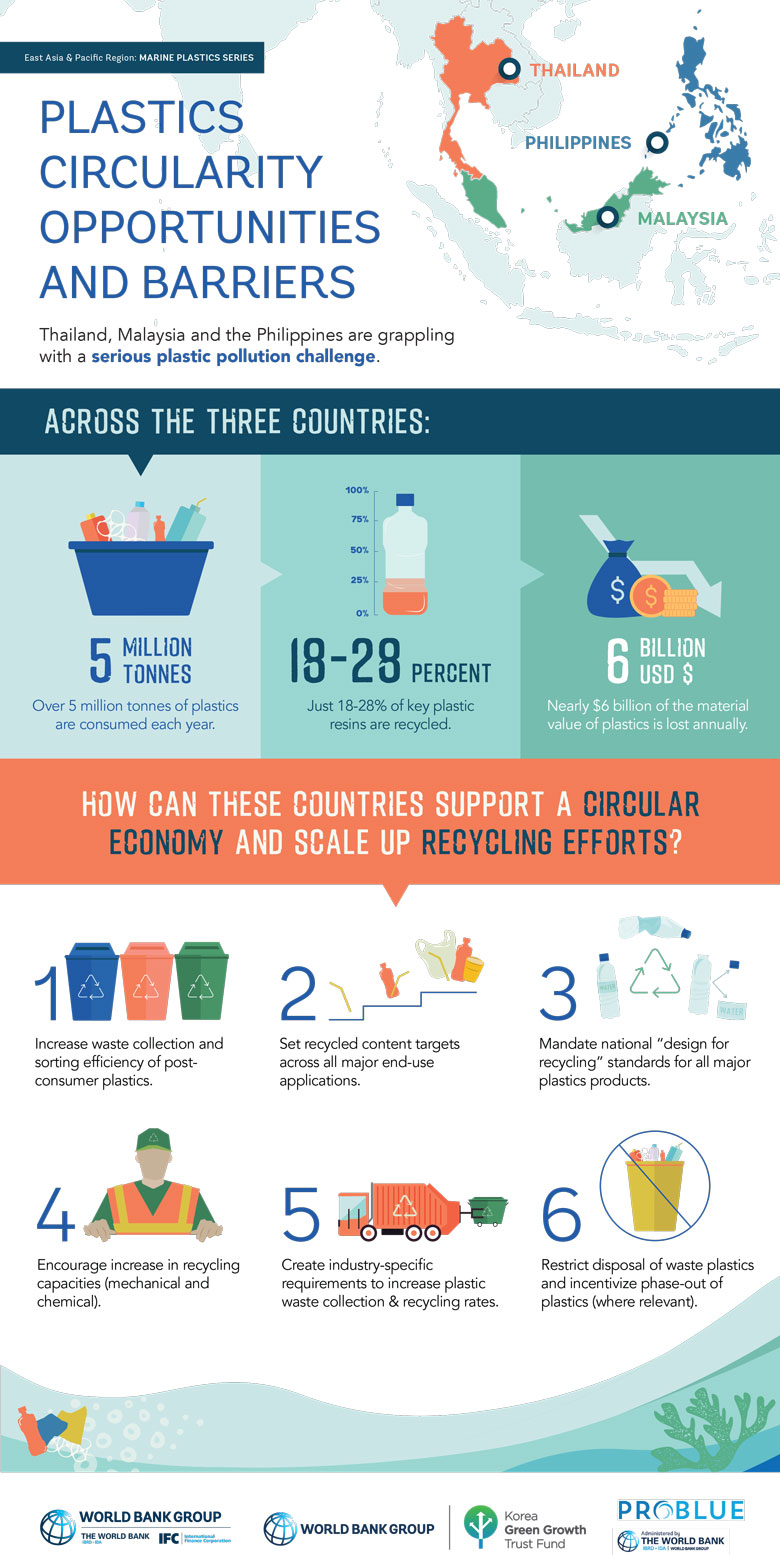

- Less than 1/4 of the total amount of key plastics resins available for recycling in Thailand, Malaysia and the Philippines are being recycled into valuable materials.

- More than 75% of the material value of plastics is lost (valued at nearly US$6 billion per year across all three countries) when plastics are discarded after single use rather than recovered and recycled representing a significant untapped business opportunity if key market barriers can be addressed.

While the barriers to plastic recycling are unique to each country, there are common interventions and actions that could help Thailand, Malaysia and the Philippines unlock additional material value by implementing recommendations such as:

- Increase sorting efficiency of post-consumer collection of plastics

- Set recycled content targets across all major end-use applications

- Mandate “design for recycling” standards for plastics, especially for packaging.

- Encourage increase in recycling capacities (mechanical and chemical).

- Implement industry-specific requirements to increase waste collection rates

- Restrict disposal of waste plastics in landfills and phase-out non-essential plastic items.