Introduction

In 2000, the World Bank Group (WBG) published Can Africa Claim the 21st Century? which described African development challenges and proposed wide-ranging reforms to transition from poverty to prosperity within the 21st century. The report highlighted four areas of priority:

- Improve governance and resolve conflict

- Invest in people

- Increase competitiveness and diversify economies

- Reduce aid dependence and debt.

Since the report’s publication, Africa has progressed in many areas but stagnated or deteriorated in others. The challenges of global development are increasingly concentrated in Africa. After a quarter century, the sequel report, Africa in the 21st Century: Governance and Inclusive Green Growth, revisits the priorities in the 2000 WBG report, analyzes how they have evolved over the last 25 years, and been affected by the unanticipated, emergent trends. The follow-up report assesses progress since 2000, reconsiders commitments around Africa’s development policies, and discusses both the challenges and potential opportunities for the continent to turn these mega trends to its advantage.

Emergent Events and Unanticipated Developments, 2000-2024

In 2000, the report could not have foreseen the global megatrends that emerged– the digital revolution, economic relations with China and other non-traditional partners, a pan-Africa free trade area, and climate change. These trends bring uncertainty and complexity, but also present great opportunities. With the right reforms, adopted on an urgent basis, Africa has a chance to claim the 21st century: rapid, sustainable growth accompanied by more and better jobs, and improved living standards.

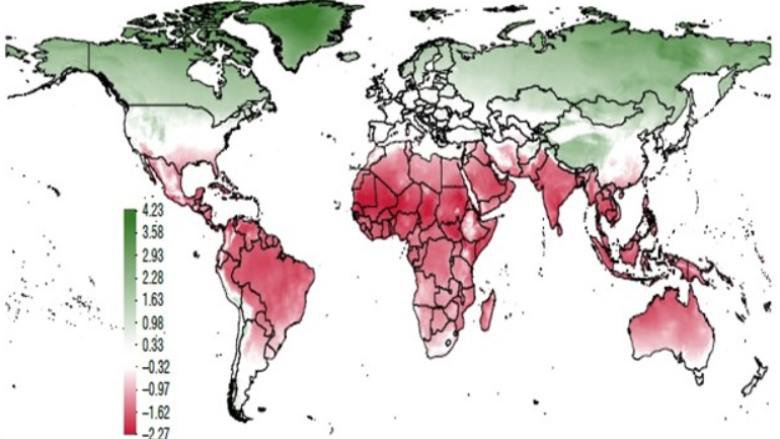

Climate change: Africa accounts for only 2-3% of the world’s carbon dioxide emissions from energy and industrial sources, but Sub-Saharan African countries are disproportionately affected by climate change. The warming over the last 50 years and the increase of global mean temperatures of 1°C above the 20th century average has challenged African economies and communities (Figure 1). In a sample of 30 African countries, two-thirds are warming faster than the world as a whole – a trend expected to continue in coming decades. From the Sahel to the Horn of Africa, and to the south of the continent and the small island nations – all are experiencing devastating effects of extreme weather patterns and slow onset changes. On a positive note, it is estimated that climate action could deliver 65 million additional jobs in 2030 in Africa as new markets develop, including on renewables.

Figure 1. Effect of a 1C Increase on Real per Capital Output

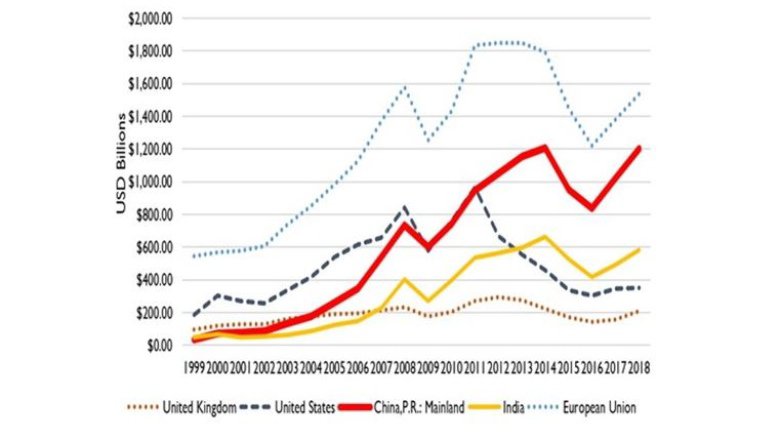

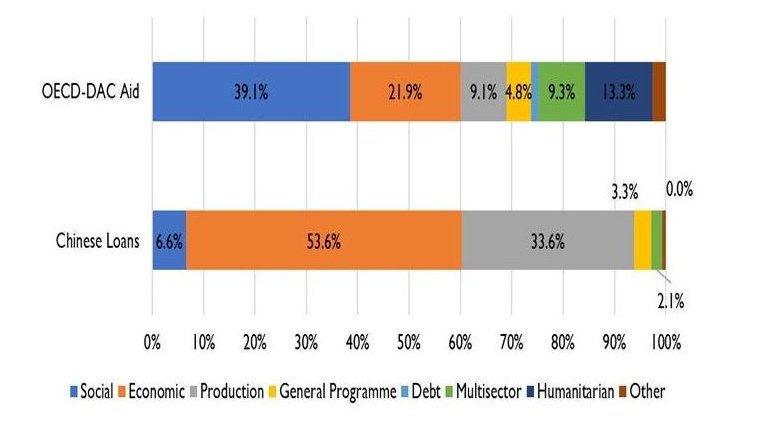

External partnerships: China and other emerging economies are changing relations between African countries and their long-established Western partners, shifting them away from the post-colonial traditional donor-recipient relationship characterized by foreign aid and unbalanced dependence. They have become visible economic partners for Africa especially in trade, natural resource extraction, and FDI. In 2000, China and India were Africa’s eighth and ninth largest trading partners whereas they are now first and second (Figure 2). Chinese lending to Africa increased from $121 million to $30.4 billion between 2000 and 2016. Lending is increasingly focused on infrastructure and production in contrast to aid from OECD-DAC partners which focuses primarily on social sectors (Figure 3).

Figure 2 Annual Trade Volume with Africa

Figure 3 Composition and Type of Usage of Aid and Loans

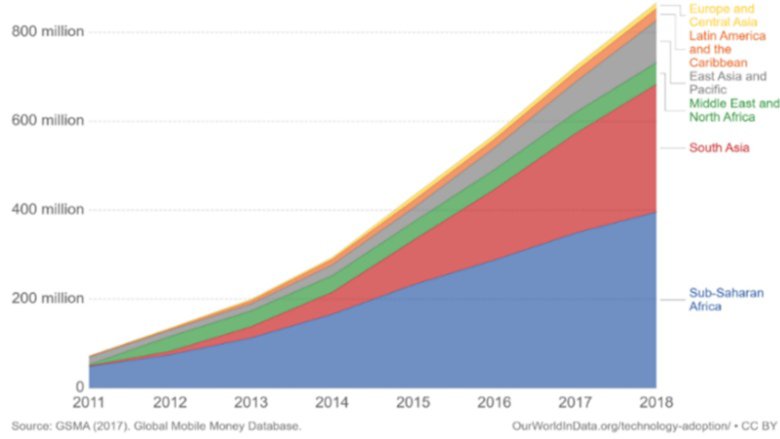

Digital revolution: The digital revolution is disrupting African economies in a positive manner: Government operations and private services are using new digital technology solutions; agribusiness, market information, power, health, and education have adapted technologies to existing functions and supplemented functions with enhanced digital capabilities. Mobile technology is allowing African countries to leapfrog technology in various industries. The deep cellular mobile coverage (Figure 4) has revolutionized financial inclusion: Sub-Saharan Africa has the greatest number of registered mobile money accounts of any region, and 160 million of the unbanked adults own a mobile phone.

Figure 4 Registered Mobile Money Account

Continental integration: So far, Africa is one of the least integrated regions. Intra-African exports made up less than 20% of total trade in 2019, compared to 60% and 70% for intra-Asian and intra-European trade respectively. In July 2019, 54 African nations agreed on the pan-continental free trade zone. This could unite economies comprising 1.3 billion people, create a $3.4 trillion economic bloc, and boost African internal and external trade. The trade deal will start by cutting tariffs for goods within the bloc and subsequently expand into other areas.

The Sequel Report

It is timely, given the ambitious global and regional frameworks which will shape development priorities for African countries: The Sustainable Development Goals by 2030; the Paris Agreement on Climate Change, the African Union’s Agenda 2063, and the Africa Continental Free Trade Area (Fakta), that the sequel report, Africa in the 21st Century: Governance and Inclusive Green Growth identifies solutions for closing the remaining development gaps.

In addressing old and new challenges, the overall objectives of growth, inclusion, and sustainability remain. First, growth: no other goals can be achieved unless the economy generates the resources needed to address them. The focus must be on raising productivity in all sectors of the economy. But shifting global economic and technological conditions mean that Africa cannot simply follow a growth recipe that has worked in other parts of the world. The region needs to define its own path to faster growth.

Second, inclusion. Rising wealth brings development only if it is widely shared. Returns must be invested to equip everyone to participate in and benefit from a growing economy. Africa’s demographics will make this task harder.

Third, sustainability. Neither growth nor inclusion will endure if there is continued degradation of natural systems including land, water, forests and the ecological services on which life depends. Since the industrial revolution, economic development has been accompanied by widespread environmental problems like pollution, deforestation, and land degradation. Only once higher wealth has been achieved could most countries put more effort into cleaning up their environment. Africa needs to strive to do better and confront these immediate threats to health and essential ecosystems functions even while still dealing with major economic and social shortcomings. What makes this harder is that it must do so while also addressing the effects of a rapidly changing climate that worsens many existing environmental problems and poses new and direct threats to lives and livelihoods.

Achieving these fundamental development objectives requires one indispensable ingredient: good governance. Competent and accountable governments need to fulfill a range of essential functions that create the conditions in which economies grow, people thrive, and the environment heals. It must set and enforce the rules of the game. It must balance competing and often contradictory interests. It must ensure the provision of goods that the market alone will not supply. And it must guarantee a fair distribution of the fruits of labor. A government can fulfill its role by working with the market, and its civil society.

Africa’s leaders must find a unique pathway to inclusive green growth. Today’s decisionmakers will not only shape the quality of life of current residents, but also of the two billion people that will likely be added to the continent over the remainder of this century. Africa in the 21st Century: Governance and Inclusive Green Growth investigates development priorities, ranging from growth related aspects like investment, diversification, digitalization and trade; to human development with an emphasis on skills; and the environment and climate resilience.