Kosovo administrative data is updated up to 2021. Spending on social protection decreased in 2021 compared to 2020. Please select "Kosovo" at Country Specific Analysis dashboard to view the data.

ECA SPEED

News and updates

-

September 2022: Kosovo 2021 (Expenditure)August 2022: Romania 2018 (Performance)

Romania survey data is updated up to 2018. Please select "Romania" at Country Specific Analysis dashboard in Performance to view the data.

-

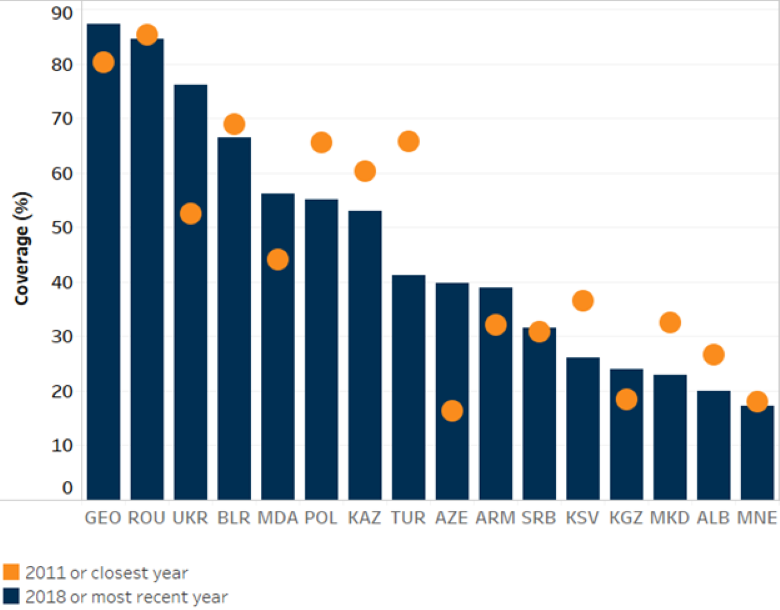

November 2022: Coverage of Q1 by all social assistance

Coverage of the poorest quintile gives an initial understanding of whether the social assistance programs are covering those who are more likely to need assistance. Take a look below to see how ECA countries compare to one another in coverage of Q1.

- Latest data year are: Georgia 2018, Romania 2016, Ukraine 2018, Belarus 2017, Moldova 2018, Poland 2016, Kazakhstan 2017, Türkiye 2018, Azerbaijan 2015, Armenia 2018, Serbia 2018, Kosovo 2017, Kyrgyz Republic 2018, North Macedonia 2016, Albania 2017 and Montenegro 2015.

- Earliest data year are 2011 for all countries, except Serbia and Poland (2010), Azerbaijan (2008) and Albania (2012).

- Q1 represents the poorest 20% of the welfare distribution net of social assistance transfers.

October 2022: Benefit-cost ratio for Social Assistance Programs in ECAThe benefit-cost ratio is an interesting indicator available in SPEED that was not yet featured in the Visual of the Month series. It is calculated as the ratio between the change in the total poverty gap pre and post-transfer, over the total amount of the transfer. In other words, it measures the share of benefits identified in the survey that actually reduce poverty given the chosen poverty line. This number tends to be higher if the programs are very well targeted towards the poor. On the other hand, if the value of the benefit is too generous, it may move people far beyond the poverty line and reduce the value of the indicator. The choice of the poverty line is also important to use this indicator – the most appropriate will depend on the programs’ objectives, but also on the characteristics of the target population and the overall welfare distribution.

The graph below shows the benefit-cost ratio of all the social assistance programs in each of the ECA countries. When considering the USD 5/day poverty line, the Kyrgyz Republic has the highest benefit-cost ratio, with 0,91 cents of each dollar spent on social assistance actually reducing the poverty gap. It is followed by Armenia, Kosovo, Montenegro, Albania, and Georgia. The countries with the lowest benefit-cost ratio are Ukraine, Poland, and Kazakhstan. This indicator is also very helpful to compare programs within a country. It is important to remember that this metric alone does not provide a full picture of the effectiveness of the social assistance systems. In fact, while some programs may be very well targeted, showing a high benefit-cost ratio, they may be very small in size, covering only a small share of the poor, or even the benefits levels might be insufficient to make beneficiaries reach the poverty line.

Chart 1. Benefit-Cost Ratio (dPG0/X) of Social Assistance Programs using different poverty lines

August 2022: SP Spending Response to the Pandemic

August 2022: SP Spending Response to the PandemicGovernments across the world responded swiftly to the pandemic induced crisis by introducing a series of social protection measures to protect the health, income and livelihoods of their populations. In ECA countries, SP policies aimed at protecting jobs, supporting firms (especially individual employers and SMEs) and protecting vulnerable groups (e.g informal workers and those who have recently fallen into poverty). However, the extent of the response has varied across the region, as several countries in ECA, especially outside the EU, were characterized by low coverage and low adequacy of social protection benefits before the COVID pandemic.

Spending on SP programs have increased in all countries where complete expenditure data is available. For Azerbaijan, overall SP spending as a share of GDP increased from around 5 percent in 2019 to almost 7 percent in 2020. Similarly, in Georgia, overall SP spending went up from 5.8 percent in 2018 to 9.5 percent in 2020, in Serbia 14 in 2019 to 17 percent in 2020 while North Macedonia and Montenegro, saw smaller increases.

Chart 1. Spending (% of GDP) on SP programs

Countries adjusted their existing social support programs through a variety of approaches, including relaxed eligibility criteria, increases in benefit levels, expansions of the coverage duration and introduction of new benefits, which led to increases in SP spending. For example, Azerbaijan increased both the number of beneficiaries as well as the benefit level for its Targeted Social Assistance (TSA) program. As a result of these changes, the number of beneficiaries increased by 12,000, and the annual TSA benefit per capita increased from USD 303 in 2019 to USD 353 in 2020. North Macedonia undertook reforms to its main social assistance program in 2019 to increase benefit levels and improve targeting. As a result, annual benefit levels per family increased from USD 745 in 2018 to USD 1,499 in 2020. Georgia expanded its main social assistance program, the TSA, in two ways: increasing the benefit amount for people with disabilities and relaxing eligibility and verification requirements for poor households to include a wider swath of those who were relatively poor, leading to a 22 percent increase in the number of beneficiaries. In addition, in Georgia, there was an emergency cash support program for laid-off and furloughed workers who lost income in 2020, which provided roughly USD 534 per capita. Similarly, Montenegro provided everyone who was registered as unemployed but not receiving any social assistance benefits a one-time cash assistance of USD 60.

Chart 2. Spending (% of GDP) on some social assistance categories

May 2022: Administrative vs Survey Data

May 2022: Administrative vs Survey DataTo evaluate the performance of Social Protection in ECA, SPEED relies on two separate sources of data: administrative and survey data. While the number of beneficiaries and the total amount they receive can also be obtained for the programs identified in the survey, this type of data do not always provide a full picture of the entire social protection system for different reasons. These challenges can be observed in the table below, comparing the number of beneficiaries for a few selected programs using administrative and survey data. The first challenge is that not all programs are captured in the survey questionnaire: the surveys (typically household budget surveys) are designed to capture many other dimensions beyond Social Protection, some programs are too small to be captured in the questionnaires, which are usually limited to largest programs. The second challenge is that the surveys are not designed to be representative of the group of beneficiaries, and the questionnaire might be applied at a time of the year during which beneficiary families are not receiving the benefits, so it is possible that they end up being underrepresented. The third reason is the way the questions are applied: actual beneficiaries might not answer that they receive the benefit either because they are not the direct beneficiary and are sometimes unaware of the program, or because they are not so familiar with the official terminology, or even for stigma or fear of losing the benefit. Finally, measurement errors associated with benefits take up and amounts might occur. In case programs are severely underreported, it could be that their overall distributional and anti-poverty effects in the population might be underestimated. However, although it is normal to see programs under-represented in surveys, the extent to which they are underrepresented varies significantly even within countries. As it can be seen from the table, in Georgia, while the Household Budget Survey captures almost the same number of total beneficiaries of old age social pension as the administrative data, it only captures 76 percent of the TSA (Targeted Social Assistance) beneficiaries. In Azerbaijan, on the other hand, the Azerbaijan Monitoring Survey of Social Welfare captures well the TSA beneficiaries but observe an over-representation of labor pensions beneficiaries. And in Serbia, while the Household Budget Survey captures 40 percent of the unemployment insurance beneficiaries, it captures less than 24 percent of the costs. Nevertheless, the indicators built using survey data still provide valuable information on the performance of social protection programs in a country, highlighting how the beneficiaries fare in comparison to the rest of the population. It is important therefore to be aware of the possible differences with administrative data when interpreting the results, to validate survey-level indicators with disaggregated administrative data when possible, and to bear in mind which population surveys are representative of.

April 2022: Are elderly poor adequately protected by social protection benefits in ECA?

April 2022: Are elderly poor adequately protected by social protection benefits in ECA?Chart 1 shows coverage of social protection, social insurance and social assistance benefits for people aged over 65 and belonging to the poorest quintile of the welfare distribution. The chart shows substantial heterogeneity across countries in ECA, especially with regards to social assistance coverage. The social insurance coverage of the elderly poor is in general high across countries, varying between 74 percent in North Macedonia to 100 percent in Belarus and Moldova. Social assistance coverage, however, shows greater heterogeneity ranging from 2 percent in Montenegro to 61 percent in Moldova*, signaling potential issues of restrictive targeting or low take-up of social assistance benefits.

Chart 1: Coverage of the poor elderly (ages 65+ in the poorest 20 percent)

*Georgia’s social assistance coverage is at 100 percent due to the classification of the non-contributory universal old age social pension into “social assistance benefits”.

Does high coverage rates in social insurance mean that the elderly poor are receiving adequate benefits? Chart 2 looks at the generosity of these benefits, defined as the ratio between the average benefit received and the mean consumption in the poorest quintile. For instance, Azerbaijan achieves almost 90 percent coverage of the elderly poor by social insurance schemes, but these benefits amount to 60 percent of the average per capita consumption, less than most other countries. On the other hand, Bosnia and Herzegovina has low coverage of social insurance and social assistance in comparison to the region but the benefits are more generous, with adequacy level of 114 percent for social insurance and 63 percent for social assistance benefits.

Chart 2: Adequacy of the benefits for poor elderly (ages 65+ in the poorest 20 percent)

Chart 3: Relative incidence of the benefits for poor elderly (ages 65+ in the bottom 20 percent)

Chart 3: Relative incidence of the benefits for poor elderly (ages 65+ in the bottom 20 percent)

- Relative incidence is the transfer amount received by a group as a share of total welfare aggregate of the group before the transfers. Relative incidence is calculated setting as expansion factor the household expansion factor multiplied by the household size. It is expressed in percentage terms.

- Program coverage is the portion of population in each group that receives the transfer.

- Adequacy is the mean transfer amount received by a group as a share of the total welfare of the beneficiaries in that group.

March 2022: Are there gender gaps in Social Protection in ECA?harts 1 through 3 show the differences in coverage by gender in each of the social protection categories. Chart 1 shows that there is not much difference across genders in Social Assistance coverage of the bottom 20% of the population, with Moldova, Azerbaijan, Turkey, Armenia and Bosnia and Herzegovina having a slightly higher coverage of women, and Romania, Belarus, Kosovo, and Kyrgyz Republic having a marginally larger coverage of men. Chart 2, on the other hand, shows that the direct coverage of Labor Market Programs is larger for men in all of the countries that we observe these types of programs in the survey. This could potentially be because men are more likely to be in the formal labor market, and therefore, are more likely to be eligible for unemployment benefits. Finally, in terms of Social Insurance Programs, Chart 3 shows that there is a larger coverage of women in several countries (Moldova, Serbia, Armenia, and Kazakhstan), with Turkey being the only country with a significantly higher coverage of men. This could be driven both by the existence of survivor pensions, usually received by women, or by lower age eligibility thresholds for women to old age pensions (given that the pension coverage of the elderly is extremely high in the entire region).

Chart 1: Coverage by Social Assistance Programs (by gender in the bottom 20 percent)

Chart 2: Direct Coverage by Labor Market Programs (by gender overall population)

Chart 3: Direct Coverage by Social Insurance Programs (by gender overall population)

Charts 4 and 5 show the differences in the average transfer value by gender, posting the ratio of the average transfer received by women, over the average transfer received by men. In Social Assistance, in nine of the countries observed, women live in households that receive a higher average transfer per capita than men, with only Belarus, Serbia and Kosovo going in the opposite direction. Chart 5, on the other hand, shows that there is still a large difference in the average transfer value in Social Insurance received by women and men in all of the countries observed. Women receive as low as 58 percent of the average transfer men receive in Kosovo, to 91 percent of the average transfer men receive in Azerbaijan. This may reflect gender gaps in formal labor force participation, contribution histories and wages throughout the lifecycle, resulting in lower average contributory pensions for women.

Chart 4: Ratio of the average Social Assistance transfer value per capita received by men and women

Chart 5: Ratio of the average Social Insurance transfer value per beneficiary received by men and women (direct beneficiaries)

While the reasons behind these differences need to be investigated further, they provide useful insights on gender differences in key aspects of Social Protection systems in the region.

Definitions

- Program coverage is the portion of population in each group that live in a household that receives the transfer.

- Direct program coverage is the portion of population in each group that receives the transfer directly.

December 2021: Coverage of social assistance: children vs total populationOne of the main components of Social Assistance (SA) in ECA and of the programs designed to support vulnerable households consists in children-related benefits. About 32 percent of SA expenditures in the region can be categorized as Family and Child Related Allowances. SPEED allows users to look at data disaggregated by age groups, one of which includes children and adolescents younger than 18 years . As it can be seen on Chart 1, we notice that in general coverage for children is higher than for the overall population for almost all countries. This is in line with the findings that child poverty rates are often higher than poverty rates in the total population, as households in the poorest quintiles tend to have more children. Some exceptions are Georgia, which rely on a large non-contributory social pension scheme, and Ukraine, that has a significant coverage through subsidies and veterans’ benefits. In some countries like Serbia and Armenia, the coverage of children and adolescents is almost twice as much as that of the general population. This can be explained by a tight and focused targeting system, since coverage of SA benefits for the total population in those countries is quite low, while it increases for the poor population. Romania is also an exceptional case, where Child state allowance is a universal benefit, a fixed sum paid for all children until they reach the age of 18 (and to children older than 18 who are continuing school)**.

Chart 1: Coverage of total population by social assistance (ages <18, total population)

Zooming in to the bottom quintile of the distribution, we observe some interesting patterns. First, from the comparison of Chart 1 and Chart 2, we notice that the coverage rates for children in the bottom quintile is higher than the overall coverage rate for children. This is likely to be driven by the fact that while some of the Family and Child Related Allowances are universal, others are targeted towards the poor. Second, while we still see a similar pattern as Chart 1 for some countries with coverage among children being higher than the overall population, for others the rates are similar. There are a few possible explanations: in some countries, the population of this quintile of the distribution might also be covered by other types of targeted benefits, increasing the coverage of the general population. Further, as pointed out above, families with children are usually overrepresented in the bottom of the distribution, meaning that probably a larger share of adults benefit indirectly from these types of benefits.

Chart 2: Coverage of poorest quintile by social assistance (ages <18, total population)

Regardless of the explanation, the coverage of poor children is arguably an important indicator to monitor, as these transfers could potentially have a double impact: reducing current poverty as well as future poverty by directly or indirectly improving their human capital development. Finally, it is important to highlight that while poor children are more covered by SA benefits than children in the total population, less than half of poor children are covered by SA benefits in 9 countries out of the 16 considered in this analysis.

*Charts only include SPEED data that is 2011 or more recent.

** Romania State Child Benefits: https://ec.europa.eu/social/main.jsp?catId=1126&langId=en&intPageId=4747

November 2021: Direct vs. Indirect beneficiaries of Social InsuranceSocial Insurance (SI) Programs provide benefits based on contributions made during current or previous employment. The largest contributory benefits under SI are old age pensions. Coverage of such programs can be measured in one of two ways:

- Coverage of Direct Beneficiaries: This measures the proportion of the population in each group that directly receives SI transfers.

- Total Coverage: This measures the proportion of the population in each group that lives in a household where at least one member directly receives SI transfers. For example, a child residing in a household where an elderly person receives SI transfers will be counted as covered.

Using data from the latest available year, Chart 1 shows coverage of social insurance using these two definitions. As can be seen, among the elderly the difference in coverage across these two measures is very small since most elderly is eligible for SI transfers in the form of retirement pensions (old, age, disability or survivors).

Chart 1: Coverage of social insurance (ages 65+, all beneficiaries vs. direct beneficiaries)

*Chart 1 only includes SPEED data that is more recent than 2010.

Chart 2 shows the corresponding number for children under the age of 18. As can be expected, in most ECA countries less than 10 percent of this age group are direct beneficiaries of SI programs (mostly survivors or disability pensions). However, the total SI coverage for children (including indirect beneficiaries) is much higher, ranging from 28 percent in Belarus to over 60 percent in Azerbaijan since children often reside in households with direct beneficiaries.

These findings have important implications when considering system reforms, as social insurance programs (and typically pensions), might end up acting as “de facto” or “unintended” welfare support mechanisms especially in context where targeted social assistance programs have limited resources.

Chart 2: Coverage of social insurance (ages 0-17, all beneficiaries vs. direct beneficiaries)

*Chart 2 only includes data that is more recent than 2010 and has direct beneficiaries’ breakdown.

October 2021: Assessing Expenditure on Social Insurance Programs in ECASocial Insurance Programs provide benefits based on contributions made during current or previous employment. These programs include contributory pensions such as old age and earnings-related pensions, disability and survivor pensions as well as certain additional contributory benefits such as sickness/injury leave and maternity/paternity benefits. The SPEED dashboards allow for a comparison of spending on social insurance across ECA countries over the last decade.

Chart 1 shows total social insurance expenditures as a share of GDP for 2011 and the latest year for which data is available in each country. The chart shows substantial heterogeneity across countries, with expenditure on social insurance varying from less than 2% of GDP in Kosovo to almost 13% of GDP in Romania.

Chart 1: Social insurance (%) of GDP, latest year available and 2011

* Earliest year is 2011 for all countries except Russia (2014), Uzbekistan (data not available).

Chart 2 provides a breakdown of social insurance expenditures by types of programs based on the latest year of data available in each country. As can be seen, old age pensions account for the largest share of social insurance expenditures, followed by disability and survival pensions.

Chart 2: Social insurance (%) of GDP, breakdown by categories, latest year available

*“Aggregate pensions” category refers to total spending on contributory pensions in countries for which a more detailed breakdown is no available.

September 2021: How much do countries spend on Labor Market Programs in ECA?Labor market programs typically include passive measures (e.g. unemployment benefits), active measures (e. g. ALMPS, training, job search support, and incentives schemes) and intermediation services (typically implemented by public employment services). The SPEED dashboards allow for a comparison of ECA countries’ spending on labor market programs as a share of GDP over the last decade.

Chart 1 shows a detailed breakdown of labor market expenditure by spending in passive measures, active measures, and intermediation services for the latest year available. Although the composition of expenditure varies substantially across the region, passive labor market programs, still play a predominant role in the majority of countries.

Chart 2 shows labor market programs spending (% of GDP) over time. The X axis is the year timeline from 2000 to 2018, the Y axis is the spending percentage, while the red dotted line indicates year 2008, corresponding to the global financial crisis. In most countries, we can observe a sharp increase on labor market programs spending in the aftermath of the 2008 crisis.

*The countries are ranked and grouped based on average spending on labor market programs (% of GDP) between 2000 to 2018.

August 2021: How much do countries spend on Social assistance in ECA?Social assistance programs typically include non-contributory benefits, whether in cash or in-kind, designed to support vulnerable groups and alleviate poverty. The SPEED dashboards allow for a direct comparison of how much countries in ECA spent on social assistance benefits as a share of GDP over the last decade. In Chart 1, the orange circles and blue bars represent spending in Social Assistance as a share of GDP in 2010 and in latest year available, respectively. Out of the 21 countries considered, social assistance expenditure increased during this period in 8 cases, decreased in 9, and remained stable in 4. A substantial increase in social assistance expenditure has been registered in Georgia, Ukraine and Kosovo, while significant reductions can be observed in Kyrgyz Republic, Estonia, Romania and North Macedonia.

Chart 2 shows instead a more detailed breakdown of social assistance expenditure by sub-components for the latest year available. Although the composition of expenditure varies substantially across the region, family and child allowances and social pensions – either for old age or disability – play an important role in social assistance in ECA.

July 2021: Impact on poverty : Expanding coverage or increasing the benefit level?

July 2021: Impact on poverty : Expanding coverage or increasing the benefit level?When it comes to the impact of a policy on poverty, there is a trade off in terms of expanding coverage or increasing the generosity of the benefits. This graph puts a light into that, showing that countries that prioritize a higher coverage rate tend to have a higher impact in reducing the poverty headcount ratio than those that prioritize a higher value of the benefit.

* Circle size represents size of poverty reduction at the 5.50 PPP dollars per day poverty line. The larger circle indicates higher impact on poverty by social assistance programs in the country.

June 2021: Are Social Assistance Benefits Well Targeted in ECA?Distribution of benefits (targeting) and distribution of beneficiaries across the five income quintiles demonstrate how well targeted Social Assistance Benefits are.

Distribution of Benefits (All Social Assistance)

Distribution of Beneficiaries (All Social Assistance)

May 2021: Is There a Trade-off Between Adequacy and Coverage of Social Assistance benefits in ECA?

May 2021: Is There a Trade-off Between Adequacy and Coverage of Social Assistance benefits in ECA?The regional comparison dashboard allows for cross-country comparison of SP indicators, such as adequacy of Social Assistance benefits for the poorest and second poorest quintile, for the latest year available.

Users can also download the underlying data by using the download button "

" at the bottom right of the dashboard to create their own visuals. By combining data on coverage and adequacy of Social Assistance benefits for Q1 and Q2 for the latest year available we can obtain the following scatterplots:

" at the bottom right of the dashboard to create their own visuals. By combining data on coverage and adequacy of Social Assistance benefits for Q1 and Q2 for the latest year available we can obtain the following scatterplots:Poorest quintile:

Second poorest quintile:

April 2021 : Coverage of Q1 by All Social Assistance

April 2021 : Coverage of Q1 by All Social AssistanceCoverage of the poorest quintile gives an initial understanding of whether the social assistance programs are covering those who are more likely to need assistance. Take a look below to see how ECA countries compare to one another in coverage of Q1.

- Latest data year are: Georgia 2018, Romania 2016, Ukraine 2018, Belarus 2017, Moldova 2018, Poland 2016, Kazakhstan 2017, Turkey 2018, Azerbaijan 2015, Armenia 2018, Serbia 2018, Kosovo 2017, Kyrgyz Republic 2018, North Macedonia 2016, Albania 2017 and Montenegro 2015.

- Earliest data year are 2011 for all countries, except Serbia and Poland (2010), Azerbaijan (2008) and Albania (2012).

- Q1 represents the poorest 20% of the welfare distribution net of social assistance transfers.

-

Upcoming

Contact Us

Quick Links inside the SPEED Website | |

Related Links | |

Other International Databases | |

| |