At the same time, elevated macro-financial vulnerabilities, including very high inflation and a volatile exchange rate, imply that one of the most important preconditions for the development of domestic sources of long-term finance and capital markets – macroeconomic stability – is not present in Türkiye. In its absence, savers and investors will prefer short-dated financial products, especially those that perform better under high inflation, or choose to invest abroad. Issuers will have to accept high costs with short-dated tenors in domestic issuance or seek long-term investors abroad, incurring in the latter case foreign exchange risk. Türkiye’s bank-dominated financial system, underdeveloped institutional investor base, and relatively low financial literacy are further structural constraints that limit the development of long-term finance.

Capital markets – often a source of long-term finance – are constrained by macro-financial challenges. While the local corporate bond market has grown steadily, it is small and sensitive to external shocks. Last year, the equity market saw a significant increase in initial public offerings (IPOs) but it is unlikely to be a sizable option to address the demand for long-term finance in the near to medium term, especially for SMEs.

Given the constraints imposed by the lack of preconditions, a recent World Bank report analyzed what can be done about developing domestic sources of long-term finance in Türkiye. The report, titled Selected Capital Markets Options to Promote Long-Term Finance for Türkiye, argues that while improving the macroeconomic preconditions for long-term finance is of the utmost importance, prioritizing selected debt and equity finance instruments with more potential while addressing challenges in the lack of preconditions could create catalytic effects.

Download the report here

In particular, the report argues that focusing on long-term financing for the green transition may be promising given the strong drive for green and sustainable finance by the private and public sector (including Türkiye’s recent move to ratify the Paris Agreement) and the increasing appetite of international investors for such investments. As such, initiatives to promote green and sustainable finance could contribute to long-term finance and capital markets development and mobilize financing for the green transition at the same time.

A stable macro-financial environment will be needed for all solutions and, ultimately, a holistic approach is needed to address capital markets constraints. However, in the short to medium term, the following could be promising opportunities:

- Debt financing. Over-reliance on bank lending points to the significant potential for corporate bonds for financial diversification and longer tenures. While maintaining a stable macro-financial environment and developing domestic savings and the investor base are critical and will require long-term efforts, tapping funding from international investors, especially those for thematic green and sustainable investing, could give a push to long-term finance in the short to medium term. Türkiye has already witnessed overseas issuance of green and sustainable debt instruments but is yet to develop its local sustainable bond market (including green bonds and green sukuks). A unified taxonomy across the financial sector would reassure thematic debt investors on the genuine green or sustainable credentials of a particular issuance. The recently issued Guidelines on Green Debt Instruments by the Capital Markets Board (CMB) of Türkiye is a welcome step forward.

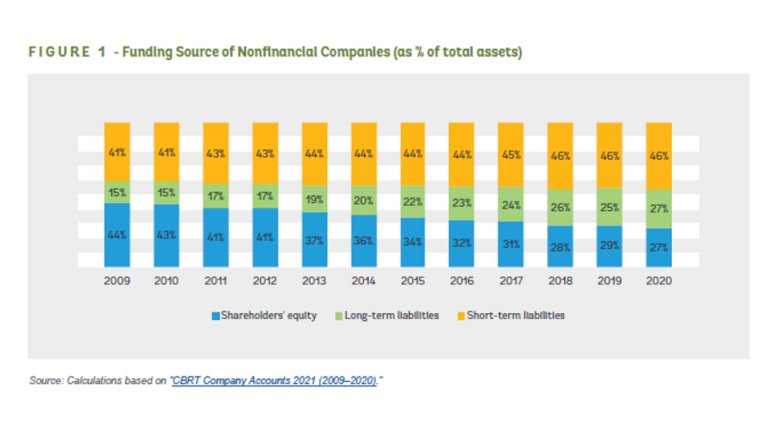

- Equity financing. High leverage and reliance on short-term debt financing highlight the importance of equity finance via private equity (PE), especially for SMEs, given that raising equity in the public markets via IPOs remains challenging for SMEs and could be sensitive to external shocks. The PE market has achieved a certain level of sophistication but remains undersized (except for venture capital [VC]), with a significant drop in activity in recent years due to macro turmoil. Promoting domestic PE investment could be useful to address SME finance challenges and help greening firms and promote green technologies amid transition risks stemming from the EU Green Deal and geopolitical pressures.

The success of any solution and initiative relies heavily on improving key preconditions and implementation capacity. A stable macro environment is critical. Improving such preconditions will take decisive, long-term efforts. Fundamental improvements of capital markets segments should go hand-in-hand with demonstration initiatives that may have potential, despite the lack of important preconditions. Design and implementation rely on capacity and governance that may require further improvement.

While assisting Türkiye in navigating through economic turmoil and improving macro-financial preconditions, the World Bank is looking forward to engaging with the Turkish authorities and the private sector on developing diversified sources of long-term finance and accelerating financing for the green transition and sustainable growth.