Download the report

The World Bank Thailand Public Spending and Revenue Assessment (PRSA) aims to support the Government of Thailand to make revenue and expenditure choices that will help to ensure a more inclusive and sustainable economy. This will require raising revenue, improving the efficiency of public spending, and ensuring that revenue and spending policy measures support the most vulnerable and are responsive to climate-related challenges. Within this overall framework, the report provides several recommendations to improve the quality of spending in the health, education, and social protection sectors, as well as a detailed assessment of fiscal policies that would contribute to the achievement of climate mitigation and adaptation goals.

Key Findings

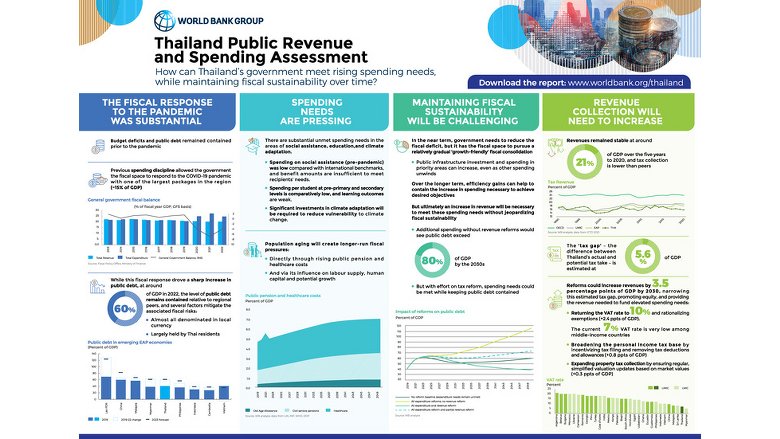

- Thailand implemented a substantial fiscal response to COVID-19 – one of the largest in the region – and was able to do so due to the fiscal space it had built up prior to the pandemic.

- Fiscal consolidation will be required over the next few years. But despite an increase in public debt to around 60 percent of GDP, the risks associated with this debt have remained relatively contained, in part because it is largely denominated in baht and held by Thai residents. This implies that the fiscal consolidation can be relatively gradual, and even as current spending declines there is room for higher levels of public investment and more spending in priority areas.

- At the same time, aging will create longer-run fiscal pressures: directly through rising public pension and healthcare costs; and because it could reduce potential growth. There are also substantial unmet spending needs in the areas of social assistance, education, and climate adaptation. The new report shows that the government will need to raise spending in these areas, and also to ensure that this spending is as efficient as possible – that it achieves desired outcomes at the lowest possible cost.

- Even after accounting for efficiency gains, a key finding of this report is that an increase in revenue will be necessary to meet these spending needs while maintaining fiscal sustainability over the longer term. With significant efforts on tax reform, revenue collection could rise by 3.5 percentage points of GDP and it would be possible to meet these needs for additional spending while keeping public debt contained.

| Download the Executive Summary |

Chapter 1: Ensuring Fiscal Sustainability

- This chapter looks in detail at the combination of policy measures needed to ensure fiscal sustainability over the medium-term and long-term. It begins by introducing the macro-fiscal context and outlining the evolution and characteristics of Thailand’s public debt, and assesses the fiscal risks associated with the COVID-related debt increase. It considers the pros and cons of different pathways for fiscal consolidation over the medium term, and the specific case for a more measured pace of consolidation that prioritizes public investment. It then considers a range of longer-term scenarios for public expenditure – accounting for spending needs associated with aging, social protection, human capital development, and climate adaptation/mitigation – and assesses the additional revenue mobilization effort required to sustainably finance these needs.

Chapter 2: Revenue Mobilization

- Given Thailand’s income level, revenue collection is low. Thailand has an estimated structural ‘tax gap’ – the difference between tax collection capacity, based on the performance of peers at a similar income level, and actual tax revenue – of around 5.6 percent of GDP. At current levels, revenues will be inadequate to meet future spending needs while maintaining fiscal sustainability. This chapter analyzes Thailand’s tax performance and potential, compared with international benchmarks, and identifies the scope for tax policy and administration reform. It assesses available options to increase tax collection, which as shown in Chapter 1 will be necessary to maintain long-term fiscal sustainability if Thailand is to meet elevated spending needs over time.

Chapter 3: Spending Trends and Priorities

- Public spending has a critical role to play in supporting Thailand’s long-term development goals and securing fiscal sustainability. Chapter 1 highlighted that Thailand’s long-term fiscal sustainability is dependent on economic growth, which in turn hinges on structural reforms to enhance productivity. Human and physical capital accumulation are key pillars of the structural reform agenda, as they can drive higher productivity and economic growth, poverty reduction, and improved wellbeing. The composition and quality of public spending is key in building human and physical capital, and thus has a critical role to play in supporting this agenda. This chapter and subsequent chapters focus on the key components of growth- and welfare-enhancing spending.

| Download the Spending Trends and Priorities Chapter |

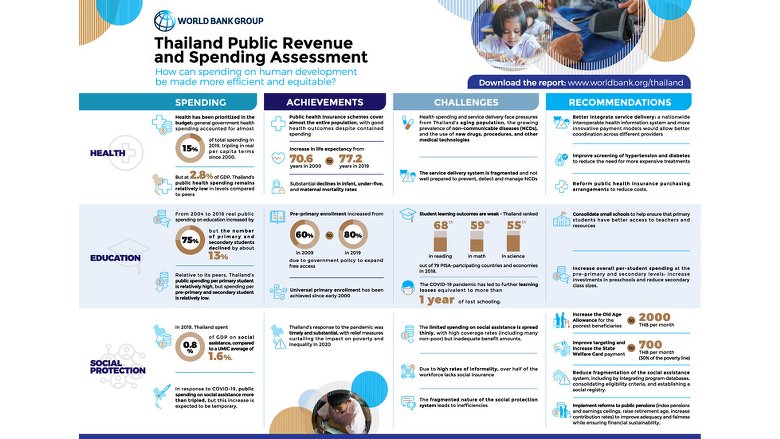

Chapter 4: Reimagining Health Care

- The Thai health system responded effectively to the pandemic and has achieved excellent public health outcomes more generally, driven by the prioritization of universal health coverage and a focus on primary health care. But the fiscal costs of health care are projected to rise as the incidence of non-communicable diseases grows, costs associated with new medical technologies and procedures increase, and the increasing numbers of elderlyrequire additional spending on healthcare. This chapter reviews the efficiency, adequacy, and outcomes of government spending on health.

| Download the Health Care Chapter |

Chapter 5: Spending for Improved Student Learning

- School learning outcomes in Thailand are relatively poor. Despite increased per-student spending over the last two decades, Thai students’ performance in the PISA mathematics and science assessments have remained stagnant at low levels, and declined significantly in reading. This is mainly due to the large number of inefficiently small and under-resourced primary schools. At the same time, spending per student at the pre-primary and secondary levels is relatively low. This chapter identifies spending inefficiencies that explain why higher levels of overall education spending in Thailand have not translated into improved learning outcomes. It ends with an analysis of various education financing scenarios that would be consistent with improved learning outcomes.

| Download the Education Chapter |

Chapter 6: Strengthening Social Protection

- This chapter analyzes the adequacy and efficiency of social protection spending in Thailand, including with reference to international comparators. It examines lessons from the significant scale-up in transfers in response to COVID-19 and proposes reforms to social assistance programs that would be cost-effective in terms of their impact on poverty and inequality, without unduly straining the overall government budget.

| Download the Social Protection Chapter |

Download the presentation on health, education, and social protection

Chapter 7 Responding to Climate Change

- This chapter introduces some of the risks to macro-fiscal stability that are posed by climate change and discusses how fiscal policy could address these risks. It examines various strategies for climate change mitigation and adaptation through a fiscal lens, assessing the possible implications for overall government spending and revenue collection. It concludes by providing recommendations to promote the adequacy, efficiency and equity of the government’s fiscal policy response to the challenges posed by climate change. Broader issues around climate change in Thailand are not explored in this chapter but will be covered in future World Bank analytical work.

| Download the Climate Change Chapter |

Chapter 8: Taxes, Transfers, and Equity

- This chapter examines the impacts of fiscal policies on poverty and inequality. Fiscal policy can be a key instrument for reducing poverty and inequality while financing important investments in public services and growth. This chapter uses the Commitment to Equity (CEQ) method to estimate the distributional welfare consequences of Thailand’s public revenues and expenditures, quantify the impact of these fiscal activities on both inequality and poverty, and estimate how effectively they redistribute income between the rich and the poor. The analysis aims to inform reforms to improve the poverty and distributional impacts of fiscal policies.