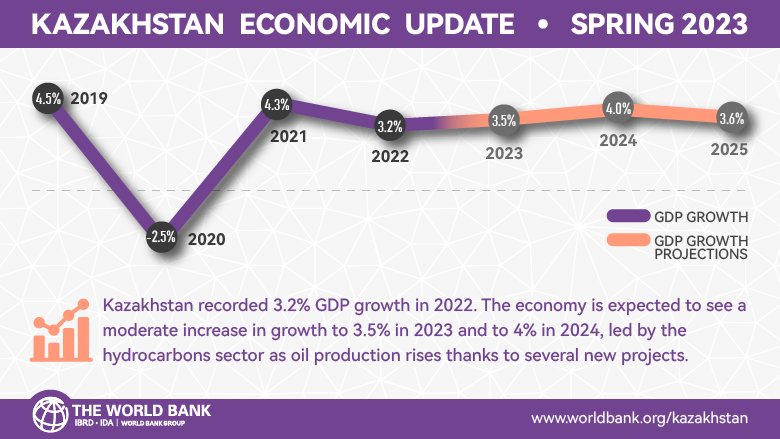

Kazakhstan’s economy is set to experience a moderate growth acceleration, with real GDP forecast to rise by 3.5 percent in 2023 and 4 percent in 2024, propelled by the hydrocarbons sector, as oil production increases. The outlook for 2023 has been revised downward from pre-war projections due to weaker growth prospects in major trading partner economies and high domestic inflation that has resulted in a loss of purchasing power.

Continued foreign direct investments into mining and the government’s housing program will likely sustain investment activity. Meanwhile, high inflation, rising borrowing costs, and increased household indebtedness may dampen growth in consumer spending.

Inflation is expected to remain high in 2023 due to elevated food prices and prices of imported intermediate goods. Inflation has surged to its highest level since the late 1990s due in part to wage increases across sectors and crisis-related fiscal measures. Prices rose broadly but food prices have been a major contributor to the surge.

Inflation is projected to remain beyond the target range of 4-6 percent in 2023 and return to it in 2024. Although supply disruptions are likely to dissipate in 2023, tight monetary policy will need to be maintained to rein in inflation expectations.

The outlook for growth faces several downside risks. Any further disruptions to the operation of the Caspian Pipeline Consortium could lead to losses in production volumes and fiscal revenues, posing downside risks to growth. The persistent high domestic inflation is a serious challenge, particularly for the most vulnerable households, and could potentially amplify the risk of social tensions. To mitigate this risk, continued monetary tightening and tighter control of fiscal spending, coupled with more effective targeting of social programs, may be necessary. Additional tightening of global financial conditions due to geopolitical tensions, energy crisis, and high inflation may pressure exchange rate, leading to potential capital flow volatility.

In the near-term, with rising geopolitical tensions, diversifying trade-logistics routes and developing alternative supply-chain links is crucial. Kazakhstan’s significant economic ties and geographic proximity to Russia leave it heavily reliant on Russian economic infrastructure. Goods shipped from the EU must pass through Russian territory before reaching Kazakhstan, making it vulnerable to supply chain disruptions. The latest phase of Russia’s invasion may further escalate sanctions imposed on Russia, causing problems in already distressed supply chains. Such disruptions can increase risk aversion and hinder business activity domestically, with western investors fearing that Kazakh businesses may be used to bypass sanctions. In this context, developing alternative trade-logistics routes is crucial to enhance supply chain resilience.

Kazakhstan needs to continue with structural reforms to address its medium-term development challenges. Economic growth has been significantly constrained by weak productivity over the past decade, hindering development prospects. Average real GDP growth has declined to less than 4 percent since the 2008 banking crisis and subsequent construction bubble burst, down from 10 percent annual expansion in 2000-2007.

Special Focus: Education in Kazakhstan – Seizing the Opportunity at the Crossroads

One of the structural deficiencies of the resource-oriented economy is declining human capital, which has been worsened by the pandemic. The closure of schools and disruptions in teaching have likely erased previous gains made by investing in education. Moreover, the learning losses from the pandemic have disproportionately affected poorer households, exacerbating inequalities. The protests witnessed in January also call for further reforms to improve inclusivity in the development of human capital across the country. To address these issues, a comprehensive approach to improve access to quality education should be considered.