Comoros has been stuck in a low-growth trap for over 40 years, with growth averaging about 2.6% in 1980–2022, and a poverty rate estimated at 39.8% in 2022. Foreign Direct Investment (FDI) inflows averaged 0.6% of GDP in 2011–2020. In terms of wealth per capita, the country’s produced physical capital declined by 27.7% between 1995 and 2018.

This limited growth can be partially explained by structural factors, such as Comoros’ weak institutions, small population, limited human and physical capital, and geographic remoteness, which weigh on private sector development.

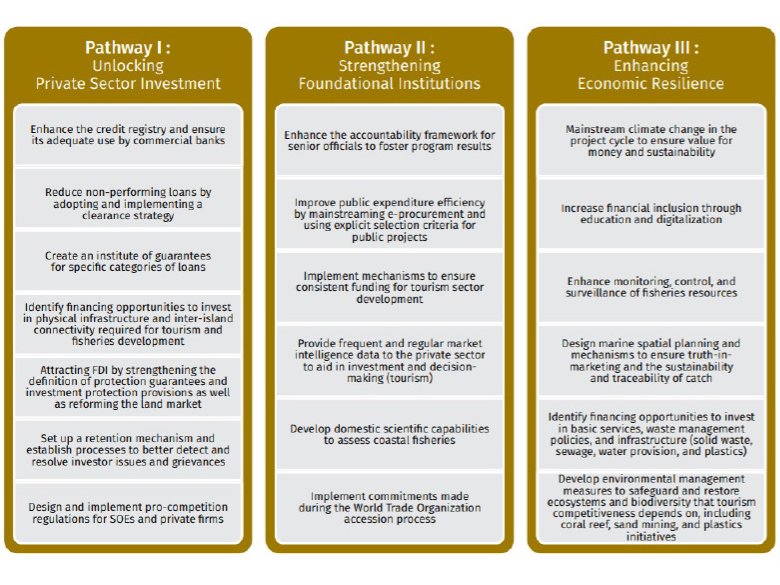

To boost growth in Comoros and embrace greater opportunities, the Comoros Country Economic Memorandum recommends three pathways: unlocking private sector investment, strengthening foundational institutions, and enhancing economic resilience revolving around a set of key policy options:

Increase private sector investment, especially considering the country’s limited fiscal resources and the inefficiency of several state-owned enterprises (SOEs):

In 2000–2019, private investment represented less than 8% of GDP, on average, in Comoros. Under a modest reform scenario, increasing private investment to 10% of GDP by 2030 and sustaining it there in 2031–50 could increase the GDP growth rate by 0.37 percentage points in 2023–50. Under an ambitious reform scenario, increasing private investment to 13% of GDP by 2030 and maintaining it until 2050 could boost the GDP growth rate by 0.62 percentage points. Achieving those macroeconomic performances will depend on the authorities’ ability to improve infrastructure and connectivity, attract foreign direct investment and stimulate domestic investment; increase financial intermediation and inclusion - including by reducing credit risk and enforcing the rule of law; and improve labor skills. However, it would also require strengthening foundational institutions, enhancing economic resilience, and ensuring the sustainable use of resources.

Increase fiscal space through enhanced domestic resource mobilization and public financial management:

Between 2016 and 2019, Comoros mobilized revenues—including grants—worth 16.8% of GDP. About four-fifths of the country’s domestic revenues come from taxes. To create fiscal space through domestic revenue mobilization, the country could strengthen the capacity of the customs and tax administrations, reduce tax expenditures, broaden the tax base, facilitate tax compliance, and improve citizen trust through enhanced fiscal transparency. An increase in public spending efficiency through better public investment management or allocation of resources could yield between 0.03 and 0.15 percentage points of additional GDP growth between 2022 and 2050.

Boost growth in under-exploited sectors such as tourism and fisheries:

The country’s productivity potential manifests itself in its abundant resources, especially related to tourism and fisheries. However, the country’s tourism sector remains at a pre-emerging stage and contributes only marginally to economic growth. Between 2015 and 2019, the number of international visitors grew by an average of 15.1% per year, and 21,400 direct and indirect jobs were created (representing 9.9% of total employment). There are three priorities for unlocking tourism-related growth: (i) increasing quality lodging options emphasizing green and inclusive development; (ii) improving inter-island connectivity; and (iii) enhancing environmental management, specifically related to waste management, controlling sand mining, and environmental degradation.

For the fisheries, marine natural capital provides an essential resource base for the development of the Comorian economy. Comorian fisheries present a considerable opportunity for sustainable economic growth because of the abundance of domestic fishing resources and an established domestic market for fish. Investing in physical market, transport, and renewable energy infrastructures would be essential to improve sector productivity. Ultimately, the development of the fisheries sector must be considered within the broader framework of a ‘blue economy’ approach.

Reap the benefits of globalization and regionalization:

Comoros has been systematically running trade deficits in recent years. The level of goods exports is lower than that of services exports, while the level of goods imports is higher than that of services imports. The country’s exports have been highly volatile because export products have been highly dependent on the impact of the weather on the harvest. Particularly, Comoros could increase the value of its exports through increased integration into the global value chain (GVC) for cloves. Comoros could also benefit from accession to the World Trade Organization (WTO) which will increase trade openness and lower its trade costs, and its participation in the African Continental Free Trade Area (AfCFTA) that could export growth and diversification, attract investment, and result into a growth acceleration. Specifically, the tourism and fisheries sectors could benefit from the WTO accession and the AfCFTA through reduced prices for imported products, enhanced standards for imports, and increased market size for exported products.