Brazil’s economy is slowly coming back from the economic havoc brought by the COVID-19 pandemic. After the historical crash of 3.3 percent in 2020, real GDP was higher in 2021 than in 2019. In 2022, GDP grew 2.9 percent. Labor market indicators reflect the economic recovery as well. While labor force participation is still slightly below its pre-pandemic level (62.1 percent), those who participate are more likely to find jobs: the unemployment rate was 7.9 percent in 2022Q4, 3.2 percentage points lower than a year earlier and 6.2 percentage points below 2020Q4.

The vulnerable population was protected by large changes in the social protection system, but there is increased dependency on government transfers. Despite the covid-19 induced crisis, the poverty rate measured at US$6.85 per day (PPP2017) decreased from 26.2 percent in 2019 to 18.7 percent in 2020 largely thanks to the cash transfers of Auxilio Emergencial program– in which the government spent 3.9 percent of the GDP. However, the promoted monetary gains were not fiscally sustainable, the government payments shrunk, and poverty bounced back to 28.4 in 2021 partly explained by the halving of AE’s coverage. In 2022, households’ real labor income is projected to finally have surpassed 2019 levels. Coupled with extra upward revision of Bolsa Familia’s benefits, poverty rate is expected to go back to a seemingly pre-pandemic trajectory at 24.3 percent (World Bank, 2023). The slow economic growth forecast will likely translate into low income growth among the less wealthy, and maintain the high correlation between poverty and state transfers.

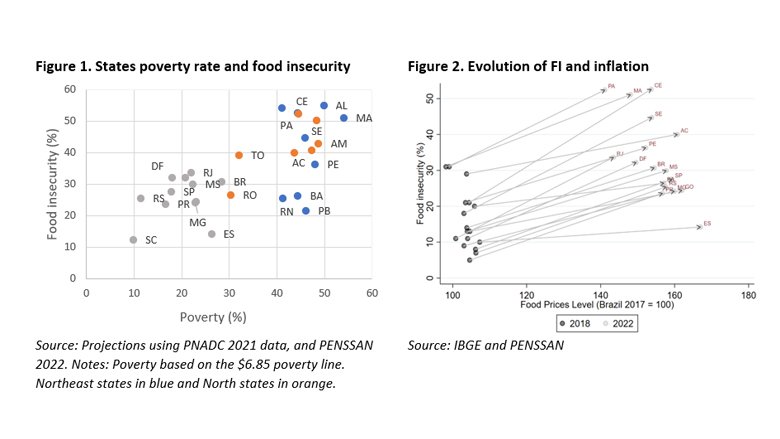

Besides poverty, other deprivations call for urgent policy response: 30.7 percent of the population suffered from moderate or severe food insecurity (FI) in 2022. The recent years decreasing role of employment labor income in reducing poverty among Brazilians (World Bank, 2022a) has made the reliance on non-labor income be accompanied by income volatility (Neri and Hecksher, 2022) and contributed to the rise of food insecurity. At least since 2014, Brazil was considered to have won over hunger (FAO, 2014). The rate of moderate and severe food insecurity was measured at 7.8 percent (PNAD 2013), compared to 16.8 approximately one decade earlier (PNAD 2003)[1]. However, the most recent surveys identified 20.5 percent of the population that experienced moderate or severe food insecurity in December 2020 (PENSANN, 2021) and 28.4 percent between November 2021 and April 2022 (PENSANN, 2022). Moreover, FI in rural areas is 1.2 times higher than that in urban areas.

Constant high food inflation may also have fueled the rise of FI in recent years. Brazil is a leading agricultural producer in the world (i.e., it is top one soybeans and sugar exporter[2]). But the agricultural economy of Brazil is largely connected to global supply chains and exportations, thus limiting its buffer capabilities to protect local consumers when global commodities prices go up. At the end, while the overall prices index to Brazilian consumers went up by 21.7 percent between the end of 2019 and the end of 2022, food prices were raised at 37.5 percent.

Even more troubling is that typically poorer states have experienced the worse effects of inflation and insecurity. Food prices, an item representing between a fifth and a quarter of poorest households’ expenditures, have thus had an enormous negative impact on households’ purchasing power. Not without reason, some of the poorest states in the country present the highest food insecurity indicators. In the poorer states of the Northeast and North regions, food prices showed as high variations as in the richer states of the South and Southeast. But having a lower capacity to cope with the soaring prices, families in the most underprivileged states (e.g.: Maranhão, Alagoas, Ceará and Pará) are experiencing a worrisome degree of food insecurity.