Link to archives: Into the Jet Age

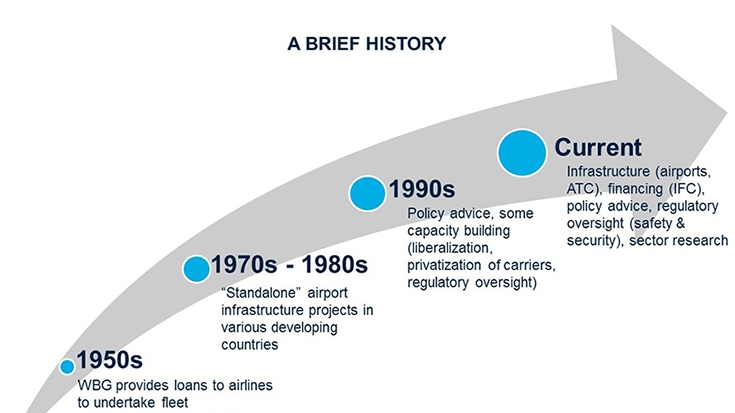

In the early days, the World Bank financed equipment such as aircraft for state-owned airlines, and undertook standalone infrastructure projects. With the liberalization of the air transport sector worldwide, and the privatization of many state-owned airlines, the World Bank shifted its pure investment focus to incorporate capacity building, policy and regulatory support.

In Fiscal Year 2015 (FY15), WBG’s Air Transport Portfolio amounted to US$1.47 billion, an increase of 2% from Fiscal Year 2014 (FY14). The Air Transport segment makes up around 3% of the WBG’s US$45 billion Transport portfolio. The WBG’s FY15 Transport portfolio consists approximately 19% of the WBG’s active portfolio of US$248 billion (excluding MIGA). The Air Transport portfolio includes around 26 projects or project components through the International Bank for Reconstruction and Development (IBRD) and International Development Association (IDA), as well as the International Finance Corporation (IFC)’s portfolio of lending and investment advisories in the aviation sector.

Major ongoing projects include the Pacific Aviation Investment Program, which is helping to promote safe and efficient air travel in the Pacific Islands by improving aviation infrastructure, management, and operations. The World Bank continues to finance large airport projects, such as the Cairo Airport Development Project - TB2. The IFC is engaged in the sector through the provision of loans, equity, and advisory services to stimulate private sector investment, for example, Zagreb International Airport, Croatia and Queen Alia International Airport, Jordan.