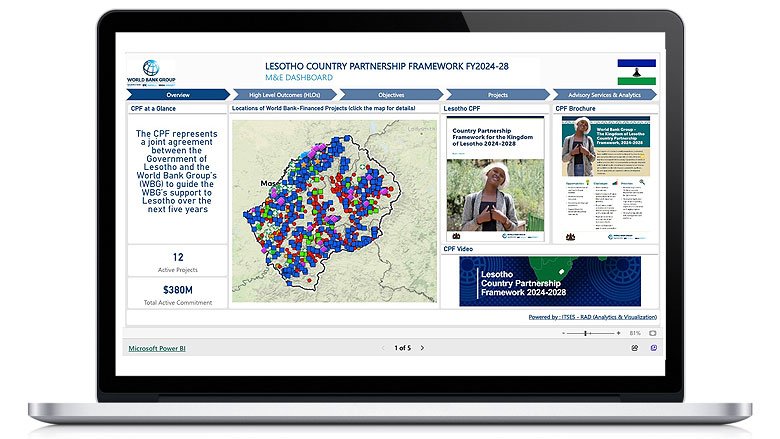

Lesotho is a small, mountainous, landlocked country surrounded by its much larger neighbor, South Africa. It has a population of about 2.3 million and a per capita gross domestic product (GDP) of $878.0 in 2023. Lesotho is classified as a lower middle-income country. It is primarily highlands, with its lowest point 1,400 meters above sea level. Previously a British protectorate, the nation gained its independence in October 1966. Lesotho is a constitutional monarchy, ruled by a King as Head of State, and governed by a 33-member Senate and a 120-member National Assembly.

The current government came into power in November 2022 and is led by Prime Minister Samuel Ntsokoane Matekane’s Revolution for Prosperity (RFP) party, in coalition with the Movement for Economic Change (MEC), Alliance for Democrats (AD), and Basotho Action Party (BAP) parties.

The government extended Lesotho’s Second National Strategic Development Plan (NSPD II) 2018/19–22/23 for another five years until 2027/28. The NSPD II’s four priorities are enhancing inclusive and sustainable economic growth and private sector-led job creation, strengthening human capital, building enabling infrastructure, and strengthening national governance and accountability systems.

Economic growth

The economy expanded by 0.9% in 2023, mainly driven by the public sector and construction, especially the Lesotho Highlands Water Project-II (LHWP-II) megaproject and its spillover effects on transportation, logistics, and financial services. The implementation of the LHWP-II project gathered pace in 2024, fueling economic growth: the economy expanded by 2.0% in the first quarter of 2024, compared to a 1.2% contraction in the same quarter of 2023. Risks to economic growth are tilted to the downside. Slower regional and global growth could dent exports and remittances. Climate shocks can reduce agricultural output, threatening livelihoods. An important downside risk to exports and jobs is that of Lesotho losing preferential access to the U.S. market if the African Growth and Opportunity Act (AGOA) is not extended beyond 2025.

The headline inflation rate declined to 6.7% in July 2024 from its peak of 9.8% in July 2022, owing mainly to lower fuel and food prices. However, domestic food prices remain high because of imported inflation caused by the weaker currency as well as the higher transportation and intermediation costs associated with the severe drought caused by El Niño in Southern Africa. Consequently, the central bank maintained the policy rate at 7.75% in July 2024 to control inflation and align domestic interest rates with regional ones.

The fiscal balance improved dramatically, from a deficit of 5.7% of GDP in 2022 to a surplus of 6.1% of GDP in 2023, owing to the more than doubling of South African Custom Union (SACU) revenues. The fiscal balance improved from a surplus of 1% of GDP in December 2023 to 4.5% in June 2024, driven by increased SACU revenues and water royalties. On the expenditure side, the implementation of the Public Procurement Act of 2023 helped contain the growth in expenditures on goods and services. Little progress has been made on the clearance of arrears, which have emerged owing to recurrent fiscal deficits in the past, and weaknesses in public financial management and public procurement.

The stock of public debt is estimated to have declined slightly to 58.0% of GDP in 2023, compared to 60.5% in 2022, mainly due to the redemption of Treasury bonds. It also declined to 55% of GDP in June 2024, from 56.9% in March 2024, in part due to Treasury bond buybacks. The majority of public debt is contracted from external sources, accounting for about 77% of total debt, while domestic sources contribute the remaining 23% in 2023. External and domestic debt stood at 46.2% and 13.6% of GDP in 2023, respectively. Lesotho’s risk of external and overall debt distress remains moderate with limited space to absorb shocks.

Last Updated: Oct 11, 2024